UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the registrant ☒ Filed by a party other than the registrant ☐

Check the appropriate box:

| ☒ | Preliminary proxy statement | |

| ☐ | Confidential, for use of the Commission only (as permitted by Rule 14a-6(e)(2)) | |

| ☐ | Definitive proxy statement | |

| ☐ | Definitive additional materials | |

| ☐ | Soliciting material pursuant to Section 240.14a-12 | |

THE FEMALE HEALTH COMPANY

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of filing fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials: | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount previously paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

SPECIAL MEETING OF STOCKHOLDERS—YOUR VOTE IS VERY IMPORTANT

THE FEMALE HEALTH COMPANY

4400 Biscayne Blvd.

Suite 888

Miami, FL 33137-3212

Dear Fellow Stockholder:

We cordially invite you to attend a special meeting of the stockholders of The Female Health Company to be held on [●], 2017, at [●] [a.m.][p.m.] local time, at [●].

On October 31, 2016, the Company announced a transaction with Aspen Park Pharmaceuticals, Inc. significantly transforming the Company from a single product company to a specialty pharmaceutical company owning multiple proprietary, large market and potentially high margin drug product opportunities. In the short time since the transaction was announced, the Company completed a significant clinical milestone in our drug under development for male enlarged prostate and launched a new and promising prescription business for the FC2 female condom expected to contribute to operating profit in the near-term.

The purpose of the special meeting is for stockholders to vote on several proposals to enable the Company to fully capitalize on these opportunities through completion of our drugs under development, as well as the successful marketing and sales of these high potential products.

Your vote to approve these proposals is critical for the Company to continue moving forward to take advantage of these opportunities.

The proposals for your approval include the following: (1) reincorporating the Company in the State of Delaware to provide the prominence, predictability and flexibility of Delaware law; (2) increasing the Company’s authorized shares of common stock from 38.5 million to 77 million shares to allow the Company to simplify its capital structure and to take advantage of potential financing for additional growth; (3) converting the Company’s Class A Convertible Preferred Stock – Series 4 into common stock to simplify the Company’s capital structure; (4) approving the Company’s 2017 Equity Incentive Plan to allow the Company to make usual, customary and necessary equity awards; (5) changing stockholder voting requirements for certain matters from two-thirds to a majority; and (6) changing the Company’s corporate name to “Veru Inc.”

The attached proxy statement contains a description of these proposals. Please give this material your careful consideration, including the opportunity presented by a diverse, multiple drug products Company.

Our board of directors recommends that stockholders vote in favor of all of the proposals to be considered at the special meeting.

Your vote is very important. Whether or not you plan to attend the special meeting, please take the time to vote by completing and mailing to us the enclosed proxy card or by granting your proxy by telephone or through the Internet. You may also cast your vote in person at the special meeting. If your shares are held in “street name,” you must instruct your broker, bank or other nominee to vote.

If you have any questions about the special meeting after reading the proxy statement, you may contact our proxy solicitor, Morrow Sodali LLC, 470 West Ave., Stamford, CT 06902. To reach Morrow Sodali LLC, stockholders may call the toll free number at (877) 787-9239 and banks and brokers may call (203) 658-9400.

On behalf of your management team and board of directors, we thank you for your support and urge you to vote “FOR” approval of all of the proposals at the special meeting.

This proxy statement is dated [●], 2017 and is first being mailed to stockholders on or about [●], 2017.

Sincerely,

Mitchell S. Steiner, MD, FACS

President and Chief Executive Officer

Mr. Elgar Peerschke

Chairman of the Board

Mr. O.B. Parrish

Vice Chairman of the Board

THE FEMALE HEALTH COMPANY

4400 Biscayne Boulevard, Suite 888

Miami, FL 33137

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

To Be Held On [●], 2017

To the Stockholders of The Female Health Company:

Notice is hereby given that a special meeting of the stockholders of The Female Health Company, a Wisconsin corporation, which we refer to as the “Company,” “we,” “us” or “our,” will be held on [●], 2017, at [●] [a.m.][p.m.] local time, at [●], for the following purposes:

| 1. | Approval of Reincorporation. To consider and vote upon a proposal, which we refer to as the “Reincorporation Proposal,” to approve and adopt an agreement and plan of merger, which we refer to as the “Reincorporation Plan of Merger,” to effect the reincorporation of the Company in the State of Delaware through the merger, which we refer to as the “Reincorporation Merger,” of the Company with and into Badger Acquisition Sub, Inc., a Delaware corporation and a wholly owned subsidiary of the Company, which we refer to as “Delaware Merger Sub.” |

| 2. | Approval of Increased Authorized Common Stock. To consider and vote upon a proposal, which we refer to as the “Share Increase Proposal,” to amend the Company’s Amended and Restated Articles of Incorporation, as amended, which we refer to as the “Articles of Incorporation,” to increase the total number of authorized shares of Common Stock from 38,500,000 shares to 77,000,000 shares. If the Reincorporation Merger is completed, this amendment will be effected through the Reincorporation Merger where the Company’s Certificate of Incorporation as a Delaware corporation will authorize 77,000,000 shares of Common Stock. If the Reincorporation Merger is not completed, this amendment will be effected through an amendment to the Company’s Articles of Incorporation. This amendment will provide the Company with a sufficient number of shares of Common Stock to issue upon the conversion of the Company’s Class A Convertible Preferred Stock—Series 4, which we refer to as the “Series 4 Preferred Stock,” and will also provide the Company with additional authorized but unissued shares for use in future financings, acquisition transactions, joint ventures and other general corporate purposes. |

| 3. | Approval of Majority Vote Standard. To consider and vote upon a proposal, which we refer to as the “Majority Vote Proposal,” to amend the Company’s Articles of Incorporation to change the vote required by stockholders to approve certain amendments to the Company’s Articles of Incorporation, certain mergers, share exchanges or conversions, certain sales of all or substantially all of the Company’s assets, and a dissolution of the Company from an affirmative vote of the holders of two-thirds of the shares entitled to vote thereon pursuant to Section 180.1706 of the Wisconsin Business Corporation Law to the holders of a majority of the voting power of the outstanding shares of capital stock of the Company entitled to vote thereon. If the Reincorporation Merger is completed, this amendment will be effected through the Reincorporation Merger where the Company’s Certificate of Incorporation as a Delaware corporation and the Delaware General Corporation Law will provide for the applicable majority voting standard. If the Reincorporation Merger is not completed, this amendment will be effected through an amendment to the Company’s Articles of Incorporation. |

| 4. | Approval of Issuance of Shares. To consider and vote upon a proposal, which we refer to as the “Share Issuance Proposal,” to approve under the listing rules of the NASDAQ Stock Market the issuance of more than 19.99% of outstanding shares of Common Stock pursuant to the conversion of the Series 4 Preferred Stock. |

| 5. | Approval of Name Change. To consider and vote upon a proposal, which we refer to as the “Name Change Proposal,” to change our corporate name from “The Female Health Company” to “Veru Inc.” If the Reincorporation Merger is completed, this amendment will be effected through the Reincorporation Merger where the Company’s Certificate of Incorporation as a Delaware corporation |

| will provide that the Company’s name is “Veru Inc.” If the Reincorporation Merger is not completed, the name change will be effected through an amendment to the Company’s Articles of Incorporation. |

| 6. | Approval of 2017 Equity Incentive Plan. To consider and vote upon a proposal, which we refer to as the “Equity Incentive Plan Proposal,” to approve the Company’s 2017 Equity Incentive Plan. |

| 7. | Adjournment or Postponement of the Special Meeting. To consider and vote upon a proposal, which we refer to as the “Adjournment Proposal,” to approve the adjournment of the special meeting if necessary or appropriate in the view of the Company’s board of directors, including to solicit additional proxies if there are not sufficient votes at the time of the special meeting to approve any of the above proposals. |

The Company’s Board of Directors recommends that the stockholders vote “FOR” each Proposal and, if necessary, “FOR” the proposal for an adjournment of the special meeting.

Only stockholders of record of Common Stock and Series 4 Preferred Stock at the close of business on [●], 2017, the record date for the special meeting, are entitled to notice of, and to vote at, the special meeting or any adjournments or postponements thereof.

Under Wisconsin law, holders of the Common Stock will not be entitled to appraisal, dissenters’ or similar rights in connection with the Reincorporation Merger. Holders of Series 4 Preferred Stock who do not vote in favor of the Reincorporation Proposal and who strictly comply with Subchapter XIII of the Wisconsin Business Corporation Law have the right to assert dissenters’ rights under that statute. For a description of the procedures that must be followed to make written demand for dissenters’ rights, see the copy of the statute which is attached as Annex G. In addition, a summary of the procedures to be followed in order to obtain payment for dissenting shares is set forth under the caption “Proposal No. 1: Approval of Reincorporation—Notice of Dissenters’ Rights” in the attached proxy statement.

YOUR VOTE IS VERY IMPORTANT. YOU MAY VOTE BY MAIL, THROUGH THE INTERNET, BY TELEPHONE OR BY ATTENDING THE SPECIAL MEETING AND VOTING BY BALLOT, ALL AS DESCRIBED IN THE ACCOMPANYING PROXY STATEMENT. IF YOUR SHARES ARE HELD OF RECORD BY A BROKER, BANK OR OTHER NOMINEE AND YOU WISH TO VOTE AT THE SPECIAL MEETING, YOU MUST OBTAIN A PROXY ISSUED IN YOUR NAME FROM THE RECORD HOLDER. IF YOU FAIL TO VOTE ON THE APPROVAL OF THE REINCORPORATION PROPOSAL, THE SHARE INCREASE PROPOSAL, THE MAJORITY VOTE PROPOSAL OR THE NAME CHANGE PROPOSAL OR FAIL TO INSTRUCT YOUR BROKER, BANK OR OTHER NOMINEE ON HOW TO VOTE FOR SUCH PROPOSALS, THE EFFECT WILL BE THE SAME AS A VOTE AGAINST THE APPROVAL OF SUCH PROPOSALS.

The accompanying proxy statement provides a detailed description of the Proposals. We urge you to read the accompanying proxy statement, including the annexes, carefully and in their entirety. If you have any questions concerning the Proposals or the accompanying proxy statement of which this notice forms a part, would like additional copies of the accompanying proxy statement or need help voting your shares of Common Stock and/or Series 4 Preferred Stock, please contact our proxy solicitor, Morrow Sodali LLC, 470 West Ave., Stamford, CT 06902. To reach Morrow Sodali LLC, stockholders may call the toll free number at (877) 787-9239 and banks and brokers may call (203) 658-9400.

By Order of the Board of Directors

Kevin J. Gilbert

Secretary

Miami, FL

[●], 2017

You are cordially invited to attend the special meeting in person. Whether or not you expect to attend the special meeting, please complete, date, sign and return the enclosed proxy card, or vote over the telephone or the Internet as instructed in these materials, as promptly as possible to ensure your representation at the special meeting. A return envelope (which is postage prepaid if mailed in the United States) is enclosed for your convenience. Even if you have voted by proxy, you may still vote in person if you attend the special meeting. Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to vote at the special meeting, you must obtain a proxy issued in your name from that record holder.

Important Notice Regarding the Availability of Proxy Materials for the Special Meeting of Stockholders to be Held on [●], 2017:

This Proxy Statement for the Special Meeting is available at www.proxyvote.com.

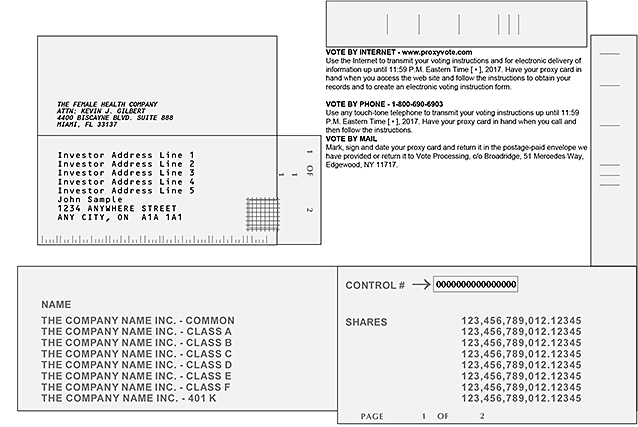

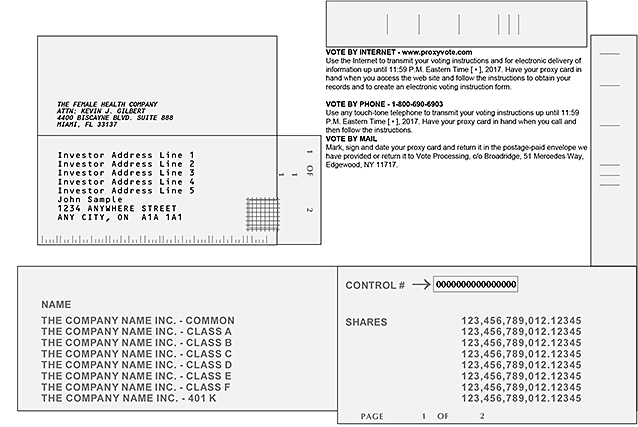

VOTING ELECTRONICALLY, BY TELEPHONE OR BY MAIL

Stockholders of the Company at the close of business on [●], 2017, the record date for the special meeting of stockholders, may submit their proxies:

| • | through the Internet by visiting a website established for that purpose at www.proxyvote.com and following the instructions; |

| • | by telephone by calling the toll-free number 1-800-690-6903 in the United States, Puerto Rico or Canada on a touch-tone phone and following the recorded instructions; or |

| • | by returning the enclosed proxy card in the provided return envelope (which is postage paid if mailed in the United States). |

To vote via telephone or Internet, please have your proxy card in front of you. A phone number and an Internet website address are contained on your proxy card. Upon entering either the phone number or the Internet website address, you will be instructed on how to proceed.

If a stockholder holds shares registered in the name of a broker, bank or other nominee, that broker, bank or other nominee will enclose or provide a voting instruction card for use in directing that broker, bank or other nominee how to vote those shares.

SUMMARY VOTING INSTRUCTIONS

YOUR VOTE IS VERY IMPORTANT

Ensure that your shares of Common Stock and Series 4 Preferred Stock are voted at the special meeting by submitting your proxy or, if your shares of Common Stock are held in the name of a broker, bank or other nominee, by contacting your broker, bank or other nominee. If you do not vote or do not instruct your broker, bank or other nominee how to vote, it will have the same effect as voting “AGAINST” the approval of the Reincorporation Proposal, the Share Increase Proposal, the Majority Vote Proposal and the Name Change Proposal.

If you hold Series 4 Preferred Stock or if your shares of Common Stock are registered in your name: submit your proxy as soon as possible by signing, dating and returning the enclosed proxy card in the enclosed postage-paid envelope, so that your shares of Series 4 Preferred Stock and/or Common Stock can be voted in favor of the Proposals at the special meeting. You may also submit your proxy by using a toll-free number or the Internet. We have provided instructions on the proxy card for using these convenient services.

If your shares of Common Stock are registered in the name of a broker, bank or other nominee: check the voting instruction card forwarded by your broker, bank or other nominee or contact your broker, bank or other nominee in order to obtain directions as to how to ensure that your shares of Common Stock are voted in favor of the Proposals at the special meeting.

If you have any questions or need assistance voting your shares, please call our proxy solicitor:

Morrow Sodali LLC

470 West Ave.—3rd Floor

Stamford, CT 06902

Banks and Brokerage Firms, please call (203) 658-9400

Stockholders, please call toll free (877) 787-9239

| Page | ||||

| 1 | ||||

| 8 | ||||

| 9 | ||||

| 9 | ||||

| 9 | ||||

| 9 | ||||

| 9 | ||||

| 10 | ||||

| 10 | ||||

| 10 | ||||

| Counting of Votes; Treatment of Abstentions and Incomplete Proxies; Broker Non-Votes |

11 | |||

| 13 | ||||

| 13 | ||||

| Delivery of Proxy Materials to Households Where Two or More Stockholders Reside |

13 | |||

| 14 | ||||

| 14 | ||||

| 15 | ||||

| 15 | ||||

| 15 | ||||

| 15 | ||||

| 16 | ||||

| 17 | ||||

| Comparison of Stockholder Rights Before and After the Reincorporation |

17 | |||

| 28 | ||||

| 28 | ||||

| Restrictions on Sales of Shares of Common Stock Received in the Reincorporation Merger |

28 | |||

| Material U.S. Federal Income Tax Consequences of the Reincorporation Merger |

28 | |||

| 29 | ||||

| 29 | ||||

| 31 | ||||

| PROPOSAL NO. 2: APPROVAL OF INCREASE IN AUTHORIZED COMMON STOCK |

32 | |||

| 32 | ||||

| 32 | ||||

| 33 | ||||

| 34 | ||||

| 35 | ||||

| 35 | ||||

| 35 | ||||

| 35 | ||||

| 37 | ||||

| 37 | ||||

| 37 | ||||

| 38 | ||||

| 38 | ||||

| 38 | ||||

| 39 | ||||

| 40 | ||||

i

| Page | ||||

| 41 | ||||

| 41 | ||||

| 41 | ||||

| 42 | ||||

| 42 | ||||

| 43 | ||||

| 43 | ||||

| 46 | ||||

| 49 | ||||

| 50 | ||||

| 51 | ||||

| 51 | ||||

| 51 | ||||

| 52 | ||||

| 52 | ||||

| Ownership of Restricted Stock Units and Stock Appreciation Rights |

52 | |||

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

53 | |||

| 55 | ||||

| 55 | ||||

| 60 | ||||

| 61 | ||||

| 62 | ||||

| 63 | ||||

| 63 | ||||

| 64 | ||||

| 65 | ||||

| 66 | ||||

| 67 | ||||

| 67 | ||||

| 67 | ||||

| 69 | ||||

| 70 | ||||

ANNEXES

| Annex A |

– | Agreement and Plan of Merger for Reincorporation Merger | A-1 | |||||

| Annex B |

– | Certificate of Incorporation of Veru Delaware | B-1 | |||||

| Annex C |

– | By-Laws of Veru Delaware | C-1 | |||||

| Annex D |

– | Articles of Amendment to the Company’s Amended and Restated Articles of Incorporation | D-1 | |||||

| Annex E |

– | 2017 Equity Incentive Plan | E-1 | |||||

| Annex F |

– | Statement of the Terms of the Series 4 Preferred Stock | F-1 | |||||

| Annex G |

– | Subchapter XIII of the WBCL—Dissenters’ Rights | G-1 |

ii

PROXY STATEMENT

SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD ON [●], 2017

This proxy statement is furnished in connection with the solicitation of proxies by the Board of Directors of The Female Health Company to be voted at the special meeting of stockholders to be held on [●], 2017, at [●] [a.m.][p.m.] local time, at [●]. This proxy statement, along with a Notice of the Special Meeting and either a proxy card or a voting instruction card, are being mailed to our stockholders beginning on or about [●], 2017.

References in this proxy statement to the “Company,” “we,” “us” or “our” are to The Female Health Company, a Wisconsin corporation, and, where the context indicates, also to the Company as reincorporated in the State of Delaware after the completion of the Reincorporation Merger and/or as renamed “Veru Inc.” pursuant to the Name Change Proposal. References in this proxy statement to “Veru Delaware” are to the Company as reincorporated in the State of Delaware after the completion of the Reincorporation Merger.

QUESTIONS AND ANSWERS ABOUT THE SPECIAL MEETING

The following are some questions that you, as a stockholder of the Company, may have regarding the special meeting, together with brief answers to those questions. We urge you to read carefully the remainder of this proxy statement, including the annexes and other documents referred to in this proxy statement, because the information in this section may not provide all of the information that might be important to you with respect to the special meeting.

| Q: | What is the Reincorporation Merger? |

| A: | Under the terms of the Reincorporation Plan of Merger, pursuant to the Reincorporation Merger, the Company will change its corporate domicile from the State of Wisconsin to the State of Delaware by merging with and into Delaware Merger Sub, with Delaware Merger Sub continuing as the surviving corporation. Upon completion of the Reincorporation Merger, each outstanding share of Common Stock will automatically be converted into one share of common stock of Delaware Merger Sub, which we refer to as the “Veru Delaware Common Stock.” If the Share Increase Proposal and the Share Issuance Proposal are both approved at the Special Meeting, each outstanding share of Series 4 Preferred Stock will automatically convert into 40 shares of Common Stock and, upon the completion of the Reincorporation Merger, each such share of Common Stock will automatically be converted into one share of Veru Delaware Common Stock. If the Share Increase Proposal and the Share Issuance Proposal are not both approved at the Special Meeting, then, upon completion of the Reincorporation Merger, each outstanding share of Series 4 Preferred Stock will automatically be converted into one share of a series of the preferred stock of Veru Delaware, which we refer to as the “Veru Delaware Preferred Stock,” that will have terms substantially the same as the Series 4 Preferred Stock. For a more complete discussion of the Reincorporation Plan of Merger, see the section entitled “Proposal No. 1: Approval of Reincorporation” beginning on page 15 of this proxy statement. A copy of the Reincorporation Plan of Merger is attached as Annex A to this proxy statement. |

| Q: | Why am I receiving these materials? |

| A: | The Company is sending these materials to its stockholders to help them decide how to vote their shares of Common Stock and Series 4 Preferred Stock with respect to the Proposals to be considered at the special meeting of the Company’s stockholders to be held on [●], 2017, which we refer to as the “Special Meeting,” and you should read them carefully. |

| Q: | What stockholder approvals are required to approve the Proposals? |

| A: | The following approvals are required to approve the Proposals: |

| • | As required by Wisconsin law, approval of the Reincorporation Proposal requires the affirmative vote of the holders of at least two-thirds of the outstanding shares of Common Stock and Series 4 Preferred Stock, voting as a single class. |

| • | As required by Wisconsin law, approval of each of the Share Increase Proposal and the Majority Vote Proposal requires (1) the affirmative vote of the holders of at least two-thirds of the outstanding shares of Common Stock and Series 4 Preferred Stock, voting as a single class, and (2) the affirmative vote of the holders of at least two-thirds of the outstanding shares of Common Stock, voting as a separate class. |

| • | As required by Wisconsin law, approval of the Name Change Proposal requires the affirmative vote of the holders of at least two-thirds of the outstanding shares of Common Stock and Series 4 Preferred Stock voting as single class. |

| • | As required by applicable NASDAQ rules, approval of the Share Issuance Proposal requires that a majority of the votes cast at the Special Meeting vote in favor of the Share Issuance Proposal, excluding for this purpose the Common Stock and Series 4 Preferred Stock issued to the former stockholders of Aspen Park Pharmaceuticals, Inc., which we refer to as “Aspen Park” in this proxy statement, pursuant to the Amended and Restated Agreement and Plan of Merger dated as of October 31, 2016 among the Company, Aspen Park and Blue Hen Acquisition, Inc., which we refer to as the “Aspen Park Merger Agreement” in this proxy statement. |

| • | Approval of the Equity Incentive Plan Proposal requires that a majority of the votes cast at the Special Meeting vote in favor of the Equity Incentive Plan Proposal. |

| • | Approval of the Adjournment Proposal requires that the votes cast in favor of the proposal exceed the votes cast against the proposal. |

If you do not vote your shares as instructed in the enclosed proxy card, or if you do not instruct your broker how to vote any shares held for you in “street name,” the effect will be a vote against the Reincorporation Proposal, the Share Increase Proposal, the Majority Vote Proposal and the Name Change Proposal.

| Q: | What stockholder approvals are required to effect the conversion of the shares of Series 4 Preferred Stock into shares of Common Stock? |

| A: | Each outstanding share of the Series 4 Preferred Stock will automatically convert into 40 shares of Common Stock upon the approval by the required vote at the Special Meeting of both the Share Increase Proposal and the Share Issuance Proposal. |

| Q: | How does the Company’s Board of Directors recommend that the Company’s stockholders vote with respect to the Proposals and the adjournment of the Special Meeting? |

| A: | The Company’s Board of Directors, which we refer to as the “Board,” recommends that the Company’s stockholders vote “FOR” each Proposal, and, if necessary, “FOR” the adjournment of the Special Meeting, including for the purpose of soliciting additional proxies if a quorum is not present or if there are not sufficient votes in favor of any Proposal. |

| Q: | How will the Company’s stockholders be affected by the Reincorporation Merger? |

| A: | After the completion of the Reincorporation Merger, each stockholder of the Company will have the same number of shares of Veru Delaware Common Stock and Veru Delaware Preferred Stock as shares of Common Stock and Series 4 Preferred Stock, respectively, such stockholder held immediately prior to the completion of the Reincorporation Merger. The Reincorporation Merger will result in the change of the |

2

| Company’s corporate domicile from the State of Wisconsin to the State of Delaware and after the Reincorporation Merger the rights of Veru Delaware’s stockholders will be governed by the Delaware General Corporation Law, which we refer to as the “DGCL,” the Veru Delaware Certificate of Incorporation and the Veru Delaware Bylaws, which may contain material differences from the rights of the Company’s stockholders under the Wisconsin Business Corporation Law, which we refer to as the “WBCL,” and the Company’s current Articles of Incorporation and Bylaws, including different terms relating to written consents by stockholders, dissenters or appraisal rights in connection with mergers and other transactions, and antitakeover statutes. See the section entitled “Proposal No. 1: Approval of Reincorporation—Comparison of Stockholder Rights Before and After the Reincorporation “ beginning on page 17 of this proxy statement for information regarding changes in the Company’s stockholders’ rights resulting from the Reincorporation Merger. |

| Q: | What are the federal income tax consequences of the Reincorporation Merger to me? |

| A: | We believe that the Reincorporation Merger will be tax-free to the Company’s stockholders and you will be entitled to the same aggregate basis in shares of Veru Delaware Common Stock and Veru Delaware Preferred Stock as the aggregate basis you have in your shares of Common Stock and Series 4 Preferred Stock, respectively. Everyone’s tax situation is different and you should consult with your personal tax advisor regarding the tax effects of the Reincorporation Merger to you. |

| Q: | Do I have dissenters’ rights in connection with the Reincorporation Merger? |

| A: | Under Wisconsin law, holders of the Common Stock will not be entitled to appraisal, dissenters’ or similar rights in connection with the Reincorporation Merger or any of the other Proposals to be considered at the Special Meeting. Holders of Series 4 Preferred Stock who do not vote in favor of the Reincorporation Proposal and who strictly comply with Subchapter XIII of the Wisconsin Business Corporation Law have the right to assert dissenters’ rights under that statute. For a description of the procedures that must be followed to make written demand for dissenters’ rights, see the copy of the statute which is attached as Annex G. In addition, a summary of the procedures to be followed in order to obtain payment for dissenting shares is set forth under the caption “Proposal No. 1: Approval of Reincorporation—Notice of Dissenters’ Rights.” |

| Q: | How many shares of Common Stock will be outstanding after the conversion of the Series 4 Preferred Stock? |

| A: | Based on 31,338,249 shares of Common Stock that were issued and outstanding as of the close of business on May 9, 2017, a total of 53,208,489 shares of Common Stock would be outstanding immediately after the conversion of the Series 4 Preferred Stock. The Company would also have an additional 7,582,879 shares of Common Stock reserved for issuance upon exercise of outstanding warrants or stock options or reserved for issuance under the Company’s 2017 Equity Incentive Plan if it is approved by stockholders at the Special Meeting. If the Share Increase Proposal is approved by stockholders at the Special Meeting to increase the number of authorized shares of Common Stock to 77,000,000 and the Series 4 Preferred Stock converts to Common Stock, the Company would have a total of 16,208,632 shares of Common Stock that are authorized and in excess of the total number of shares of Common Stock outstanding or reserved for issuance upon exercise of outstanding warrants or stock options or reserved for issuance under the Company’s 2017 Equity Incentive Plan if it is approved by stockholders at the Special Meeting. |

| Q: | What effects would the conversion of the Series 4 Preferred Stock into Common Stock have on stockholders? |

| A: | If both the Share Increase Proposal and the Share Issuance Proposal are approved by the required vote at the Special Meeting, each outstanding share of the Series 4 Preferred Stock will automatically convert into |

3

| 40 shares of Common Stock. The effects of the conversion of the Series 4 Preferred Stock include the following: |

| • | The voting power of the current holders of the Common Stock would be diluted by the conversion of the Series 4 Preferred Stock into shares of Common Stock. The Series 4 Preferred Stock has one vote per share and generally votes with the Common Stock on a one share to one share basis. Accordingly, holders of Series 4 Preferred Stock currently have 546,756 votes for any matter for which they are eligible to vote. The conversion of the Series 4 Preferred Stock would result in the issuance of an additional 21,870,240 shares of Common Stock, or an additional 21,323,484 votes, to the former holders of Series 4 Preferred Stock. |

| • | The conversion of the Series 4 Preferred Stock would provide the holders of the Series 4 Preferred Stock with shares of Common Stock that offer greater liquidity due to the listing of the Common Stock on the NASDAQ Stock Market. Subsequent resales of such shares of Common Stock may cause the market price of our Common Stock to decline. We have also entered into a Registration Rights Agreement with the former Aspen Park stockholders whereby we have agreed to register for resale the shares of Common Stock they received pursuant to the Aspen Park Merger Agreement, including shares of Common Stock issuable upon conversion of the Series 4 Preferred Stock. |

| • | The conversion of the Series 4 Preferred Stock would simplify the Company’s capital structure by eliminating the Series 4 Preferred Stock and allowing the Company to only have one class of stock outstanding, the Common Stock. |

| • | Because the Series 4 Preferred Stock is treated as temporary equity for U.S. generally accepted accounting principles rather than permanent equity like the Common Stock, the conversion of the Series 4 Preferred Stock to Common Stock would have the effect of increasing the Company’s total stockholders’ equity by approximately $18 million. |

| • | The conversion of the Series 4 Preferred Stock would increase the number of shares of Common Stock outstanding which may have the effect of reducing the Company’s earnings per share. However, the conversion of the Series 4 Preferred Stock would not significantly dilute the economic interest of the current holders of the Common Stock as the Series 4 Preferred Stock currently participates with the Common Stock in dividends on an as converted basis and currently participates with the Common Stock in distributions upon a liquidation of the Company (including certain transactions involving an acquisition of the Company) on an as converted basis as long as the amount to be paid to the holders of the Series Preferred Stock on an as converted basis exceeds $1.00 per share of Series 4 Preferred Stock ($546,756 in the aggregate for all shares of Series 4 Preferred Stock). |

| • | The Company’s President and Chief Executive Officer and three other directors hold shares of Series 4 Preferred Stock that would be converted into Common Stock if the Share Increase Proposal and Share Issuance Proposal are approved by stockholders at the Special Meeting. |

For additional information regarding the terms of the Series 4 Preferred Stock, see Annex F to this proxy statement and the section entitled “Proposal 4: Approval of Issuance of Common Stock—Summary of the Terms of the Series 4 Preferred Stock.”

| Q: | When and where will the Special Meeting take place? |

| A: | The Special Meeting will be held on [●], 2017 at [●] [a.m.] [p.m.], local time, at [●]. |

| Q: | Who can attend and vote at the Special Meeting? |

| A: | The Company’s stockholders of record as of the close of business on [●], 2017, the record date for the Special Meeting, are entitled to receive notice of, attend, and vote at the Special Meeting. Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to vote at the Special Meeting, you must obtain a proxy issued in your name from that record holder. |

4

| Q: | What do I need to do now and how do I vote? |

| A: | The Company urges you to read this proxy statement carefully, including its annexes, and to consider how the Proposals described in this proxy statement may affect you and the Company as a whole. |

| To vote, you may provide your proxy instructions in three different ways. First, you can mail your signed proxy card in the enclosed return envelope. Alternatively, you can provide your proxy instructions by calling the toll-free call center set up for this purpose indicated on the enclosed proxy card and following the instructions provided. Please have your proxy card available when you call. Finally, you can provide your proxy instructions over the Internet by accessing the website indicated on the enclosed proxy card and following the instructions provided. Please have your proxy card available when you access the web page. Please provide your proxy instructions only once and as soon as possible so that your shares can be voted at the Special Meeting. |

| Q: | What happens if I do not return a proxy card or otherwise provide proxy instructions or if I elect to abstain from voting? |

| A: | If you do not submit a proxy card, provide proxy instructions by telephone or over the Internet or vote at the Special Meeting, your shares will not be counted as present for the purpose of determining the presence of a quorum, which is required to transact business at the Special Meeting, and your actions will have the same effect as a vote “AGAINST” the Reincorporation Proposal, the Share Increase Proposal, the Majority Vote Proposal and the Name Change Proposal. |

| If you sign, date and mail your proxy card without indicating how you wish to vote, your proxy will be counted as present for the purpose of determining the presence of a quorum for the Special Meeting and all of your shares will be voted “FOR” the Proposals. However, if you submit a proxy card or provide proxy instructions by telephone or over the Internet and affirmatively elect to abstain from voting, your proxy will be counted as present for the purpose of determining the presence of a quorum for the Special Meeting and your abstention will have the same effect as a vote “AGAINST” the Reincorporation Proposal, the Share Increase Proposal, the Majority Vote Proposal, the Share Issuance Proposal, the Name Change Proposal and the Equity Incentive Plan Proposal. |

| Q: | If my shares are held in “street name” by a broker or other nominee, will my broker or nominee vote my shares for me? |

| A: | If your shares are held in “street name” in a stock brokerage account or by another nominee, you must provide the record holder of your shares with instructions on how to vote your shares. Please follow the voting instructions provided by your broker or other nominee. Please note that you may not vote shares held in street name by returning a proxy card directly to the Company or by voting in person at the Special Meeting unless you provide a “legal proxy,” which you must obtain from your broker or other nominee. |

| If you do not give instructions to your broker, your broker can vote your shares with respect to “discretionary” items, but not with respect to “non-discretionary” items. The Reincorporation Proposal, the Share Increase Proposal, the Majority Vote Proposal, the Share Issuance Proposal and the Equity Incentive Plan Proposal are all non-discretionary matters. Therefore, if you do not instruct your broker or other nominee on how to vote your shares then: |

| • | your broker or other nominee may not vote your shares on such Proposals, and the resulting broker non-vote will have the effect of a vote “AGAINST” the Reincorporation Proposal, the Share Increase Proposal and the Majority Vote Proposal and will have no effect on the Share Issuance Proposal and the Equity Incentive Plan Proposal; and |

| • | your broker or other nominee may vote your shares on the Adjournment Proposal. |

5

| Q: | May I vote in person? |

| A: | If you hold shares of Series 4 Preferred Stock or if your shares of Common Stock are registered directly in your name with the Company’s transfer agent, you are considered, with respect to those shares, the “stockholder of record,” and the proxy materials and proxy card are being sent directly to you. If you are the stockholder of record, you may attend the Special Meeting and vote your shares in person, rather than signing and returning your proxy card or otherwise providing proxy instructions by telephone or over the Internet. |

| If your shares of Common Stock are held in a brokerage account or by another nominee, you are considered the beneficial owner of shares held in “street name,” and these proxy materials are being forwarded to you together with a voting instruction card. As the beneficial owner, you are also invited to attend the Special Meeting. However, since a beneficial owner is not the stockholder of record, you may not vote these shares in person at the Special Meeting unless you obtain a “legal proxy” from the broker or other nominee that holds your shares giving you the right to vote the shares in person at the Special Meeting. |

| Q: | May I revoke or change my vote after I have provided proxy instructions? |

| A: | Yes. You may revoke or change your vote at any time before your proxy is voted at the Special Meeting. You can do this in one of three ways. First, you can send a written notice to the Company stating that you would like to revoke your proxy. Second, you can submit new proxy instructions either on a new proxy card, by telephone or over the Internet, as and if applicable. Third, you can attend the Special Meeting and vote in person as described above. Your attendance at the Special Meeting will not, by itself, revoke your proxy. If you have instructed a broker or other nominee to vote your shares, you must follow directions received from your broker or other nominee to change those instructions. |

| Q: | What constitutes a quorum? |

| A: | Stockholders who hold a majority of the shares of Common Stock and Series 4 Preferred Stock outstanding as of the close of business on the record date for the Special Meeting must be present either in person or by proxy to constitute a quorum to conduct business at the Special Meeting. In addition, as to the consideration of the Share Increase Proposal and the Majority Vote Proposal at the Special Meeting, which require approval by the holders of at least two-thirds of the outstanding shares of Common Stock, voting as a separate class, a quorum will also require the presence in person or by proxy of stockholders who hold a majority of the shares of Common Stock outstanding as of the close of business on the record date for the Special Meeting. |

| Q: | Who is paying for this proxy solicitation? |

| A: | The Company will pay for the cost and expense of preparing, filing, assembling, printing and mailing this proxy statement, and any amendments thereto, the proxy card and any additional information furnished to the Company’s stockholders. Morrow Sodali LLC, 470 West Ave., Stamford, CT 06902, has been retained by the Company to assist in the solicitation of proxies, for a fee of approximately $8,500 plus reimbursement of reasonable out-of-pocket expenses. The Company may also reimburse brokers, custodians, nominees and fiduciaries for their costs of soliciting and obtaining proxies from beneficial owners, including the costs of reimbursing brokers, custodians, nominees and fiduciaries for their costs of forwarding this proxy statement and other solicitation materials to beneficial owners. In addition, proxies may be solicited without extra compensation by directors, officers and employees of the Company by mail, telephone, fax or other methods of communication. |

| Q: | Where can I find the voting results of the Special Meeting? |

| A: | The Company intends to announce preliminary voting results at the Special Meeting and publish final results in a Current Report on Form 8-K that will be filed with the SEC following the Special Meeting. All reports the Company files with the SEC are publicly available when filed. |

6

| Q: | Whom should I contact if I have any questions about the Proposals or the Special Meeting? |

| A: | Stockholders may contact our proxy solicitor, Morrow Sodali LLC, 470 West Ave., Stamford, CT 06902. To reach Morrow Sodali LLC, stockholders may call the toll free number at (877) 787-9239 and banks and brokers may call (203) 658-9400. |

| Q: | What happens if I sell my shares after the record date but before the Special Meeting? |

| A: | If you transfer any of your shares of Common Stock or Series 4 Preferred Stock after the record date but before the date of the Special Meeting, you will retain your right to vote at the Special Meeting. |

| Q: | Should I send in my stock certificates now? |

| A: | No. Certificates currently issued for shares of Common Stock will automatically represent shares of Veru Delaware Common Stock upon completion of the Reincorporation Merger and holders of Common Stock will not be required to exchange stock certificates as a result of the Reincorporation Merger. |

| If the Share Increase Proposal and the Share Issuance Proposal are both approved at the Special Meeting, the Company will notify each holder of shares of Series 4 Preferred Stock that such shares have converted into shares of Common Stock and will provide each such holder with instructions for exchanging certificates currently issued for the Series 4 Preferred Stock for the shares of Common Stock (or shares of Veru Delaware Common Stock in the event the Reincorporation Merger has been completed) they are entitled to receive. If the Share Increase Proposal and the Share Issuance Proposal are not both approved at the Special Meeting, certificates currently issued for shares of Series 4 Preferred Stock will automatically represent shares of Veru Delaware Preferred Stock upon completion of the Reincorporation Merger and holders of Series 4 Preferred Stock will not be required to exchange stock certificates as a result of the Reincorporation Merger. |

| Q: | What do I do if I receive more than one proxy statement or set of voting instructions? |

| A: | If you hold shares directly as a record holder and also in “street name” or otherwise through a nominee, you may receive more than one proxy statement and/or set of voting instructions relating to the Special Meeting. These should each be voted and/or returned separately to ensure that all of your shares are voted. |

7

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This proxy statement contains or may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements can be identified by the fact that they do not relate strictly to historical or current facts. Statements that include words such as “may,” “will,” “project,” “might,” “expect,” “believe,” “anticipate,” “intend,” “could,” “would,” “estimate,” “continue,” “pursue,” “possible” or “potential” or the negative of these words or other words or expressions of similar meaning may identify forward-looking statements. These forward-looking statements are found at various places throughout this proxy statement and relate to a variety of matters, including but not limited to the impact of the Company’s strategies on operating results and the Company’s ability to complete its drugs under development and successfully market and sell such products. These forward-looking statements are made on the basis of the current beliefs, expectations and assumptions of the Company’s management, are not guarantees of performance and are subject to significant risks and uncertainty. Important factors that could cause actual results to differ materially from those described in forward-looking statements contained herein include, but are not limited to:

| • | product demand and market acceptance; |

| • | competition in the Company’s markets and the risk of new competitors and new competitive product introductions; |

| • | risks relating to the ability of the Company to obtain sufficient financing on acceptable terms when needed to fund development and operations; |

| • | risks related to the development of the Company’s product portfolio, including clinical trials, regulatory approvals and time and cost to bring to market; |

| • | many of the Company’s products are at an early stage of development and the Company may fail to successfully commercialize such products; |

| • | risks related to intellectual property, including licensing risks; |

| • | the Company’s reliance on its international partners in the consumer sector and on the level of spending on the female condom by country governments, global donors and other public health organizations in the global public sector; |

| • | the economic and business environment and the impact of government pressures; |

| • | risks involved in doing business on an international level, including currency risks, regulatory requirements, political risks, export restrictions and other trade barriers; and |

| • | the Company’s production capacity, efficiency and supply constraints. |

Additional factors that could cause actual results to differ materially from those described in the forward-looking statements are set forth in the Company’s Annual Report on Form 10-K for the year ended September 30, 2016, which was filed with the SEC on December 12, 2016, under the heading “Item 1A-Risk Factors,” and in subsequent reports on Forms 10-Q and 8-K.

You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this proxy statement. The Company undertakes no obligation to publicly update or release any revisions to these forward-looking statements, whether as a result of new information, future events or otherwise, after the date of this proxy statement or to reflect the occurrence of unanticipated events, except as required by law.

8

The Company is furnishing this proxy statement to its stockholders in connection with the solicitation of proxies by the Board for use at the Special Meeting of the Company’s stockholders with respect to the Reincorporation Proposal, the Share Increase Proposal, the Majority Vote Proposal, the Share Issuance Proposal, the Name Change Proposal, the Equity Incentive Plan Proposal and the Adjournment Proposal.

The Special Meeting will be held on [●], 2017 at [●] [a.m.] [p.m.], local time, at [●].

Purpose of the Special Meeting

At the Special Meeting, and any adjournments or postponements thereof, the Company’s stockholders will be asked to:

| • | approve the Reincorporation Proposal; |

| • | approve the Share Increase Proposal; |

| • | approve the Majority Vote Proposal; |

| • | approve the Share Issuance Proposal; |

| • | approve the Name Change Proposal; |

| • | approve the Equity Inventive Plan Proposal; and |

| • | approve the Adjournment Proposal. |

THE MATTERS TO BE CONSIDERED AT THE SPECIAL MEETING ARE OF GREAT IMPORTANCE TO THE COMPANY’S STOCKHOLDERS. ACCORDINGLY, STOCKHOLDERS ARE URGED TO READ AND CAREFULLY CONSIDER THE INFORMATION PRESENTED IN THIS PROXY STATEMENT.

The Board, by a unanimous vote, recommends that the stockholders of the Company vote:

| • | “FOR” the Reincorporation Proposal, which is a proposal to approve and adopt the Reincorporation Plan of Merger, thereby approving the Reincorporation Merger to change the Company’s domicile from the State of Wisconsin to the State of Delaware; |

| • | “FOR” the Share Increase Proposal, which is a proposal to approve an amendment to the Company’s Articles of Incorporation to increase the total number of authorized shares of Common Stock from 38,500,000 shares to 77,000,000 shares; |

| • | “FOR” the Majority Vote Proposal, which is a proposal to amend the Company’s Articles of Incorporation to change the vote required by stockholders to approve certain amendments to the Company’s Articles of Incorporation, certain mergers, share exchanges or conversions, certain sales of all or substantially all of the Company’s assets, and a dissolution of the Company from an affirmative vote of the holders of two-thirds of the shares entitled to vote thereon pursuant to Section 180.1706 of the WBCL to the holders of a majority of the voting power of the outstanding shares of capital stock of the Company entitled to vote thereon; |

| • | “FOR” the Share Issuance Proposal, which is a proposal to approve under the listing rules of the NASDAQ Stock Market the issuance of more than 19.99% of the Company’s Common Stock pursuant to the conversion of the Series 4 Preferred Stock; |

9

| • | “FOR” the Name Change Proposal, which is a proposal to amend the Company’s Articles of Incorporation to change the Company’s corporate name from “The Female Health Company” to “Veru Inc.”; |

| • | “FOR” the Equity Incentive Plan Proposal, which is a proposal to approve the Company’s 2017 Equity Incentive Plan; and |

| • | “FOR” the Adjournment Proposal, which is a proposal to approve the adjournment of the Special Meeting if necessary or appropriate in the view of the Board, including to solicit additional proxies if there are not sufficient votes at the time of the Special Meeting to approve the Reincorporation Proposal, the Share Increase Proposal, the Majority Vote Proposal, Share Issuance Proposal, the Name Change Proposal or the Equity Incentive Plan Proposal. |

Record Date; Shares Entitled to Vote

The Board has fixed [●], 2017 as the record date for the determination of stockholders entitled to notice of, and to vote at, the Special Meeting and any adjournment or postponement thereof. Only holders of record of shares of Common Stock or Series 4 Preferred Stock at the close of business on the record date are entitled to receive notice of, attend, and vote at the Special Meeting. A stockholder whose shares are held of record by a broker, bank or other nominee as of the record date, should check the voting instruction card forwarded by the stockholder’s broker, bank or other nominee in order to obtain directions on how to vote the stockholder’s shares, and such a stockholder must obtain a proxy issued in such stockholder’s name from that record holder in order to attend and vote at the Special Meeting.

At the close of business on the record date, the Company had outstanding and entitled to vote [●] shares of Common Stock and 546,756 shares of Series 4 Preferred Stock.

Holders of Common Stock and/or Series 4 Preferred Stock are entitled to vote on all of the Proposals at the Special Meeting, except that holders of the Common Stock and Series 4 Preferred Stock issued to the former stockholders of Aspen Park pursuant to the Aspen Park Merger Agreement are not entitled to vote such shares on the Share Issuance Proposal. Each share of Common Stock outstanding on the record date and each share of Series 4 Preferred Stock outstanding on the record date entitles the holder thereof to one vote on each matter properly brought before the Special Meeting, exercisable in person or by proxy, but excluding for the Share Issuance Proposal shares of Common Stock and Series 4 Preferred Stock issued to the former stockholders of Aspen Park pursuant to the Aspen Park Merger Agreement. For each matter scheduled for a vote at the Special Meeting, you may vote “For” or “Against” or you may “Abstain” from voting.

To conduct the business described above at the Special Meeting, the Company must have a quorum present. Stockholders who hold a majority of Common Stock and Series 4 Preferred Stock outstanding as of the close of business on the record date for the Special Meeting must be present either in person or by proxy to constitute a quorum to conduct business at the Special Meeting. In addition, as to the consideration of the Share Increase Proposal and the Majority Vote Proposal at the Special Meeting, which require approval by the holders of at least two-thirds of the outstanding shares of Common Stock, voting as a separate class, a quorum will also require the presence in person or by proxy of stockholders who hold a majority of the shares of Common Stock outstanding as of the close of business on the record date for the Special Meeting.

The Proposals being submitted for approval by the Company’s stockholders at the Special Meeting will be approved or rejected on the basis of certain specific voting thresholds. In particular:

| • | Reincorporation Proposal requires the affirmative vote of the holders of at least two-thirds of the outstanding shares of Common Stock and Series 4 Preferred Stock, voting as a single class; |

10

| • | Share Increase Proposal requires (1) the affirmative vote of the holders of at least two-thirds of the outstanding shares of Common Stock and Series 4 Preferred Stock, voting as a single class and (2) the affirmative vote of the holders of at least two-thirds of the outstanding shares of Common Stock, voting as a separate class; |

| • | Majority Vote Proposal requires (1) the affirmative vote of the holders of at least two-thirds of the outstanding shares of Common Stock and Series 4 Preferred Stock, voting as a single class and (2) the affirmative vote of the holders of at least two-thirds of the outstanding shares of Common Stock, voting as a separate class; |

| • | Share Issuance Proposal requires that a majority of the votes cast at the Special Meeting vote in favor of the Share Issuance Proposal, excluding for this purpose the Common Stock and Series 4 Preferred Stock issued to the former stockholders of Aspen Park pursuant to the Aspen Park Merger Agreement; |

| • | Name Change Proposal requires the affirmative vote of the holders of at least two-thirds of the outstanding shares of Common Stock and Series 4 Preferred Stock, voting as single class; |

| • | Equity Incentive Plan Proposal requires that a majority of the votes cast at the Special Meeting vote in favor of the Equity Incentive Plan Proposal; and |

| • | Adjournment Proposal requires that the votes cast in favor of the Proposal exceed the votes cast against the Proposal. |

If you do not vote your shares as instructed in the enclosed proxy card, or if you do not instruct your broker how to vote any shares held for you in “street name,” the effect will be a vote against the Reincorporation Proposal, the Share Increase Proposal, the Majority Vote Proposal and the Name Change Proposal.

Counting of Votes; Treatment of Abstentions and Incomplete Proxies; Broker Non-Votes

Stockholder of Record: Shares Registered in Your Name

The transfer agent for the Common Stock is Computershare Investor Services, LLC. If, as of the record date, your shares of Common Stock were registered directly in your name with the transfer agent, then you are a stockholder of record. In addition, if you hold shares of Series 4 Preferred Stock you are also a stockholder of record.

If you are a stockholder of record, you may vote in person at the Special Meeting, vote by proxy by telephone, vote by proxy over the Internet, or vote by completing and returning the enclosed proxy card. Whether or not you plan to attend the Special Meeting, the Company urges you to vote by proxy to ensure that your vote is counted. You may still attend the Special Meeting and vote in person even if you have already voted by proxy.

Stockholders of at the close of business on [●], 2017, the record date for the Special Meeting, may vote as follows:

| • | in person by coming to the Special Meeting and completing a ballot that you will receive when you arrive; |

| • | through the Internet by visiting a website established for that purpose at www.proxyvote.com and following the instructions; |

| • | by telephone by calling the toll-free number 1-800-690-6903 in the United States, Puerto Rico or Canada on a touch-tone phone and following the recorded instructions; or |

| • | by returning the enclosed proxy card in the provided return envelope (which is postage paid if mailed in the United States). |

11

To vote via telephone or Internet, please have your proxy card in front of you. A phone number and an Internet website address is contained on your proxy card. Upon entering either the phone number or the Internet website address, you will be instructed on how to proceed.

If a stockholder does not submit a proxy card, provide proxy instructions by telephone or over the Internet or vote at the Special Meeting, such stockholder’s shares will not be counted as present for the purpose of determining the presence of a quorum, which is required to transact business at the Special Meeting, and will have the same effect as a vote “AGAINST” the Reincorporation Proposal, the Share Increase Proposal, the Majority Vote Proposal and the Name Change Proposal.

If a stockholder signs, dates and mails a proxy card without indicating how such stockholder wishes to vote, such proxy card will be counted as present for the purpose of determining the presence of a quorum for the Special Meeting and all of such stockholder’s shares will be voted “FOR” each Proposal. However, if a stockholder submits a proxy card or provides proxy instructions by telephone or over the Internet and affirmatively elects to abstain from voting, such proxy will be counted as present for the purpose of determining the presence of a quorum for the Special Meeting and the abstention will have the same effect as a vote “AGAINST” the Reincorporation Proposal, the Share Increase Proposal, the Majority Vote Proposal, the Share Issuance Proposal, the Name Change Proposal and the Equity Incentive Plan Proposal.

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If, on the record date, your shares of Common Stock were held in an account at a broker, bank or other nominee, rather than in your name, then you are the beneficial owner of shares of Common Stock held in “street name” and a voting instruction card is being forwarded to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the Special Meeting. Since you are not the stockholder of record, you may not vote your shares of Common Stock in person at the Special Meeting unless you request and obtain a valid proxy from your broker or other agent.

Simply follow the voting instructions in the voting instruction card to ensure your vote is counted. Alternatively, you may vote by telephone or over the Internet as instructed by your broker or bank. To vote in person at the Special Meeting, you must obtain a valid proxy from your broker, bank or other agent. Follow the instructions from your broker or bank included with these proxy materials, or contact your broker or bank to request a proxy form.

If you do not give instructions to your broker, your broker can vote your shares of Common Stock with respect to “discretionary” items, but not with respect to “non-discretionary” items. Non-discretionary matters include director elections and other matters like those involving a matter that may substantially affect the rights or privileges of stockholders, such as mergers, acquisitions, share issuances or stockholder proposals. On non-discretionary items for which you do not give your broker instructions, the shares will be treated as broker non-votes. Discretionary items are proposals considered routine under the rules of the New York Stock Exchange on which your broker may vote shares held in street name in the absence of your voting instructions.

The Reincorporation Proposal, the Share Increase Proposal, the Majority Vote Proposal, the Share Issuance Proposal and the Equity Incentive Plan Proposal are all non-discretionary matters. Therefore, if you do not instruct your broker or other nominee on how to vote your shares then:

| • | your broker or other nominee may not vote your shares of Common Stock on such Proposals, and the resulting broker non-vote will have the effect of a vote “AGAINST” the Reincorporation Proposal, the Share Increase Proposal and the Majority Vote Proposal and will have no effect on the Share Issuance Proposal and the Equity Incentive Plan Proposal; and |

| • | your broker or other nominee may vote your shares of Common Stock on the Adjournment Proposal. |

12

Counting Votes

Votes will be counted by the inspector of election appointed for the Special Meeting, who will separately count “For,” “Against,” “Abstain” and broker non-votes.

If you wish to change your vote with respect to any Proposal, you may do so by revoking your proxy at any time prior to the commencement of voting with respect to that Proposal at the Special Meeting.

If you are the record holder of your shares, you can revoke your proxy by:

| • | sending a written notice stating that you would like to revoke your proxy to Kevin J. Gilbert, Secretary of the Company, at 4400 Biscayne Boulevard, Suite 888, Miami, FL 33137; |

| • | submitting new proxy instructions with a later date either on a new proxy card, by telephone or over the Internet, as and if applicable; or |

| • | attending the Special Meeting and voting in person (but note that your attendance alone will not revoke your proxy). |

If you are a stockholder of record, revocation of your proxy or voting instructions by written notice must be received by 11:59 p.m., Eastern Time, on [●], 2017, although you may also revoke your proxy by attending the Special Meeting and voting in person. Simply attending the Special Meeting will not, by itself, revoke your proxy. Your most current proxy card or telephone or Internet proxy is the one that will be counted. If your shares are held in street name by your broker or bank as a nominee or agent, you should follow the instructions provided by your broker or bank to revoke your proxy.

The Company will pay for the cost and expense of preparing, filing, assembling, printing and mailing this proxy statement, any amendments thereto, the proxy card and any additional information furnished to the Company’s stockholders. Morrow Sodali LLC, 470 West Ave., Stamford, CT 06902, has been retained by the Company to assist in the solicitation of proxies, for a fee of approximately $8,500 plus reimbursement of reasonable out-of-pocket expenses. The Company may also reimburse brokerage houses and other custodians, nominees and fiduciaries for their costs of soliciting and obtaining proxies from beneficial owners, including the costs of reimbursing brokerage houses and other custodians, nominees and fiduciaries for their costs of forwarding this proxy statement and other solicitation materials to beneficial owners. In addition, proxies may be solicited without extra compensation by directors, officers and employees of the Company by mail, telephone, email, fax or other methods of communication.

Delivery of Proxy Materials to Households Where Two or More Stockholders Reside

The SEC has adopted rules that permit companies and intermediaries (e.g., brokers) to satisfy the delivery requirements for proxy statements with respect to two or more stockholders sharing the same address by delivering a single proxy statement addressed to those stockholders. This process, which is commonly referred to as “householding,” potentially means extra convenience for stockholders and cost-savings for companies.

In connection with the Special Meeting, a number of brokers with account holders who are the Company’s stockholders will be householding the proxy materials. As a result, a single proxy statement will be delivered to multiple stockholders sharing an address unless contrary instructions have been received from the applicable stockholders. Once a stockholder receives notice from its broker that they will be householding communications to such stockholder’s address, householding will continue until such stockholder is notified otherwise or until such stockholder revokes its consent. If, at any time, a stockholder no longer wishes to participate in

13

householding and would prefer to receive a separate proxy statement, such stockholder should notify its broker or contact the Company at (312) 595-9123. Stockholders who currently receive multiple copies of this proxy statement at their address and would like to request householding of their communications should contact their broker.

All the stockholders as of the record date, or their duly appointed proxies, may attend the Special Meeting. If you are a registered stockholder (that is, if you hold your stock in your own name) and you wish to attend the Special Meeting, please bring your proxy and evidence of your stock ownership, such as your most recent account statement, to the Special Meeting. You should also bring valid picture identification.

If your shares are held in street name in a stock brokerage account or by another nominee and you wish to attend the Special Meeting, you need to bring a copy of a brokerage or bank statement to the Special Meeting reflecting your stock ownership as of the record date. You should also bring valid picture identification.

Under Wisconsin law, holders of the Common Stock will not be entitled to appraisal, dissenters’ or similar rights in connection with the Reincorporation Merger or any of the other Proposals to be considered at the Special Meeting.

Holders of Series 4 Preferred Stock who do not vote in favor of the Reincorporation Proposal and who strictly comply with Subchapter XIII of the Wisconsin Business Corporation Law have the right to assert dissenters’ rights under that statute. For a description of the procedures that must be followed to make written demand for dissenters’ rights, see the copy of the statute which is attached as Annex G. In addition, a summary of the procedures to be followed in order to obtain payment for dissenting shares is set forth under the caption “Proposal No. 1: Approval of Reincorporation—Notice of Dissenters’ Rights.”

14

PROPOSAL NO. 1: APPROVAL OF REINCORPORATION

The Board has approved a proposal to approve and adopt the Reincorporation Plan of Merger to effect the change of the Company’s corporate domicile from the State of Wisconsin to the State of Delaware through the Reincorporation Merger. Pursuant to the Reincorporation Proposal, the Company’s stockholders are being asked to approve and adopt the Reincorporation Plan of Merger. This section provides additional information regarding the Reincorporation Merger. In connection with the Reincorporation Merger, the Veru Delaware Certificate of Incorporation and Veru Delaware Bylaws have been prepared to include provisions commonly maintained by publicly traded companies incorporated in Delaware to maximize management efficiency, maximize value for Veru Delaware under Delaware law and preserve stockholder rights under Delaware law. We urge you to read carefully the following sections of this proxy statement, including the related annexes.

No Change to Business of the Company

The Reincorporation Merger will effect only a change in the legal domicile of the Company and other changes of a legal nature. The Reincorporation Merger will not result in any change in the business, fiscal year, accounting, location of the principal executive offices, assets or liabilities of the Company. After the completion of the Reincorporation Merger, each stockholder of the Company will have the same number of shares of Veru Delaware Common Stock and Veru Delaware Preferred Stock as shares of Common Stock and Series 4 Preferred Stock, respectively, such stockholder held immediately prior to the completion of the Reincorporation Merger. If the Share Increase Proposal and the Share Issuance Proposal are both approved at the Special Meeting, each outstanding share of Series 4 Preferred Stock will automatically convert into 40 shares of Common Stock and, upon the completion of the Reincorporation Merger, each such share of Common Stock will automatically be converted into one share of Veru Delaware Common Stock.

The Reincorporation Merger will result in the change of the Company’s name to “Veru Inc.” if the Name Change Proposal is also approved. The Reincorporation Merger will not effect any change in the Board or the executive officers of the Company.

Reasons for the Reincorporation

The Board believes that there are significant advantages to the Company that will arise as a result of a change of domicile to Delaware. Further, the Board believes that any direct benefit that Delaware law provides to a corporation also indirectly benefits the stockholders, who are the owners of the corporation. The Board believes that there are several reasons why a reincorporation in Delaware is in the best interests of the Company and its stockholders. As explained in more detail below, these reasons can be summarized as follows:

| • | Prominence, Predictability and Flexibility of Delaware Law. For many years Delaware has followed a policy of encouraging incorporation in its state and, in furtherance of that policy, has been a leader in adopting, construing and implementing comprehensive, flexible corporate laws responsive to the legal and business needs of corporations organized under its laws. Many corporations have chosen Delaware initially as a state of incorporation or have subsequently changed corporate domicile to Delaware in similar manner. Because of Delaware’s prominence as the state of incorporation for many major corporations, both the legislature and courts in Delaware have demonstrated the ability and a willingness to act quickly and effectively to meet changing business needs. The Delaware courts have developed considerable expertise in dealing with corporate issues, and a substantial body of case law has developed construing Delaware law and establishing public policies with respect to corporate legal affairs. |

| • | Well-Established Principles of Corporate Governance. There is substantial judicial precedent in the Delaware courts as to the legal principles applicable to measures that may be taken by a corporation and to the conduct of a corporation’s board of directors, such as under the business judgment rule and |

15

other standards. The Board believes that the Company’s stockholders will benefit from the well-established principles of corporate governance that Delaware law affords.

| • | Increased Ability to Attract and Retain Qualified Directors. Both Wisconsin and Delaware law permit a corporation to include a provision in the charter to reduce or eliminate the monetary liability of directors for breaches of fiduciary duty in certain circumstances. The frequency of claims and litigation pursued against directors and officers has greatly expanded the risks facing directors and officers of corporations in carrying out their respective duties. The amount of time and money required to respond to such claims and to defend such litigation can be substantial. The Board believes that, in general, Delaware law regarding a corporation’s ability to limit director liability is more developed and provides more guidance than Wisconsin law. As a result, the Board believes that the more favorable corporate environment afforded by Delaware will enable the Company to compete more effectively with other public companies in attracting and retaining new directors. |

The Company has a relatively small market capitalization compared to many other publicly-traded companies, including companies in the industries in which the Company competes. In the view of the Board and the management, this results in the Company facing significant competition for qualified and experienced independent directors. The current corporate governance environment and the additional requirements under the Sarbanes-Oxley Act of 2002, SEC rules and NASDAQ rules place a premium on publicly-traded corporations having experienced, independent directors. Accordingly, there is an increased demand for highly qualified independent directors. At the same time, the current environment has increased the scrutiny on director actions and the perception of increased liability of independent directors. As a result, the Board believes that fewer qualified persons are willing to serve as independent directors, particularly on boards of smaller public companies, and qualified directors are choosing to serve on fewer boards.

The Board believes that reincorporation in Delaware will enhance the Company’s ability to attract and retain directors. The vast majority of public corporations are domiciled in Delaware. Not only is Delaware law most familiar to directors, Delaware law provides, as noted above, greater flexibility, predictability and responsiveness to corporate needs and more certainty regarding indemnification and limitation of liability of directors, all of which will enable the directors to act in the best interest of the Company. As a result, the Board believes that the more favorable corporate environment afforded by Delaware will enable the Company to compete more effectively with other public companies, many of which are already incorporated in Delaware, to retain the Company’s current directors and attract and retain new directors.

The following discussion is qualified by reference to the text of the Reincorporation Plan of Merger and proposed forms of the Veru Delaware Certificate of Incorporation and the Veru Delaware Bylaws, copies of which are attached to this proxy statement as Annexes A, B and C, respectively.

The Company’s capital stock currently consists of 38,500,000 authorized shares of common stock, $0.01 par value per share, of which 31,338,249 shares were issued and outstanding as of May 9, 2017, and 5,015,000 authorized shares of preferred stock, $0.01 par value per share, of which 546,756 were issued and outstanding as of such date and designated as Class A Convertible Preferred Stock—Series 4. If the Share Increase Proposal is approved, the Company’s capital stock will increase from 38,500,000 authorized shares of common stock to 77,000,000 shares of common stock, but there will be no change to the number of authorized shares of preferred stock. Please see the section entitled “Proposal No. 2: Approval of Increase in Authorized Common Stock” beginning on page 32 of this proxy statement for further discussion. If the Reincorporation Merger is completed but the Share Increase Proposal is not approved, the Company’s authorized capital stock will be 38,500,000 authorized shares of common stock, $0.01 par value per share, and 5,015,000 authorized shares of preferred stock, $0.01 par value per share, after the completion of the Reincorporation Merger.

16