Proposed Merger of Aspen Park Pharmaceuticals and The Female Health Company Transforming into A Leading Men’s and Women’s Health Care Company April 2016 NASDAQ: FHCO Exhibit 99.1

This communication contains forward-looking statements, including those regarding the proposed merger transaction between FHC and APP and the integration of our two businesses. These statements are subject to known and unknown risks, uncertainties and assumptions, and if any such risks or uncertainties materialize or if any of the assumptions prove incorrect, our actual results could differ materially from those expressed or implied by such statements. These risks and uncertainties include but are not limited to: the risk that the proposed transaction may not be completed in a timely manner or at all; the satisfaction of conditions to completing the transaction, including the ability to secure approval by a two-thirds vote of FHC’s shareholders; risks that the proposed transaction could disrupt current plans and operations; costs, fees and expenses related to the proposed transaction; risks related to the development of APP's product portfolio, including regulatory approvals and time and cost to bring to market; risks relating to the ability of the combined company to obtain sufficient financing on acceptable terms when needed to fund development and company operations; the risk that, even if it is completed, we may not realize the expected benefits from the transaction; and other risks described in FHC’s filings with the Securities and Exchange Commission ("SEC"), including our Annual Report on Form 10-K for the year ended September 30, 2015 and our Quarterly Report on Form 10‑Q for the quarter ended December 31, 2015. These documents are available on the "SEC Filings" section of our website at http://fhcinvestor.com. All forward-looking statements are based on information available to us as of the date hereof, and FHC does not assume any obligation and does not intend to update any forward-looking statements, except as required by law. 3_85 Forward Looking Statements

Additional Information about the Proposed Transaction and Where You Can Find It FHC plans to file a proxy statement with the SEC relating to a solicitation of proxies from its shareholders in connection with a special meeting of shareholders of FHC to be held for the purpose of voting on matters relating to the proposed transaction. BEFORE MAKING ANY VOTING DECISION WITH RESPECT TO THE PROPOSED TRANSACTION, FHC SECURITY HOLDERS ARE URGED TO READ THE PROXY STATEMENT AND OTHER RELEVANT MATERIALS WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. The proxy statement and other relevant materials, and any other documents filed by FHC with the SEC, may be obtained free of charge at the SEC's website at www.sec.gov. In addition, shareholders of FHC may obtain free copies of the documents filed with the SEC by contacting FHC's Chief Financial Officer at (312) 595-9123, or by writing to Chief Financial Officer, The Female Health Company, 515 North State Street, Suite 2225, Chicago, Illinois 60654. Interests of Certain Participants in the Solicitation FHC and its executive officers and directors may be deemed to be participants in the solicitation of proxies from the shareholders of FHC in favor of the proposed transaction. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement and other relevant materials to be filed with the SEC when they become available.

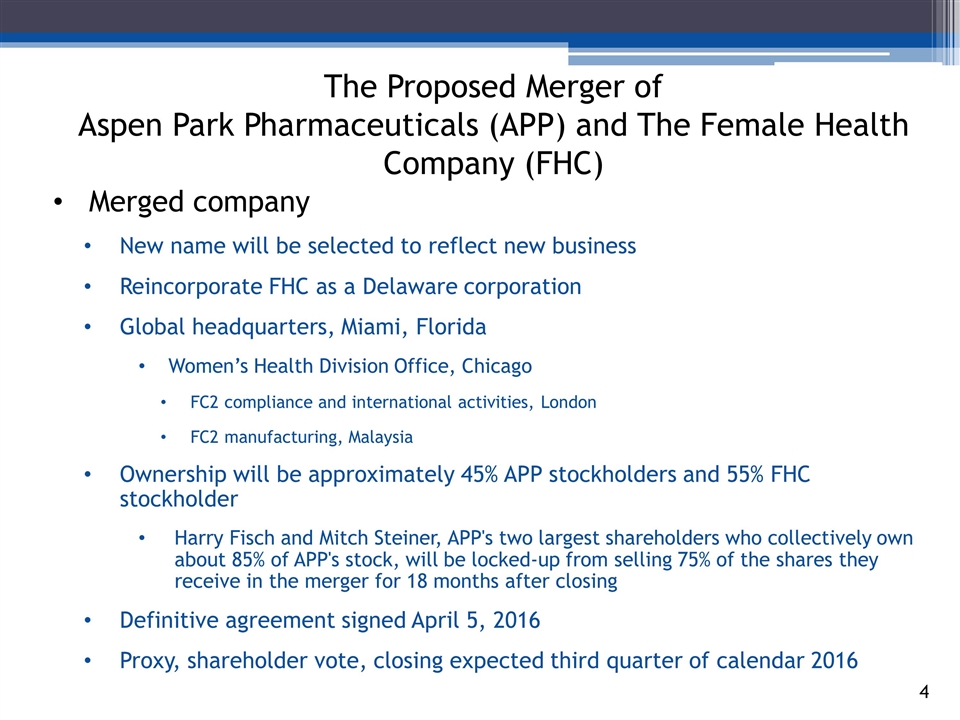

Merged company New name will be selected to reflect new business Reincorporate FHC as a Delaware corporation Global headquarters, Miami, Florida Women’s Health Division Office, Chicago FC2 compliance and international activities, London FC2 manufacturing, Malaysia Ownership will be approximately 45% APP stockholders and 55% FHC stockholder Harry Fisch and Mitch Steiner, APP's two largest shareholders who collectively own about 85% of APP's stock, will be locked-up from selling 75% of the shares they receive in the merger for 18 months after closing Definitive agreement signed April 5, 2016 Proxy, shareholder vote, closing expected third quarter of calendar 2016 3_85 The Proposed Merger of Aspen Park Pharmaceuticals (APP) and The Female Health Company (FHC)

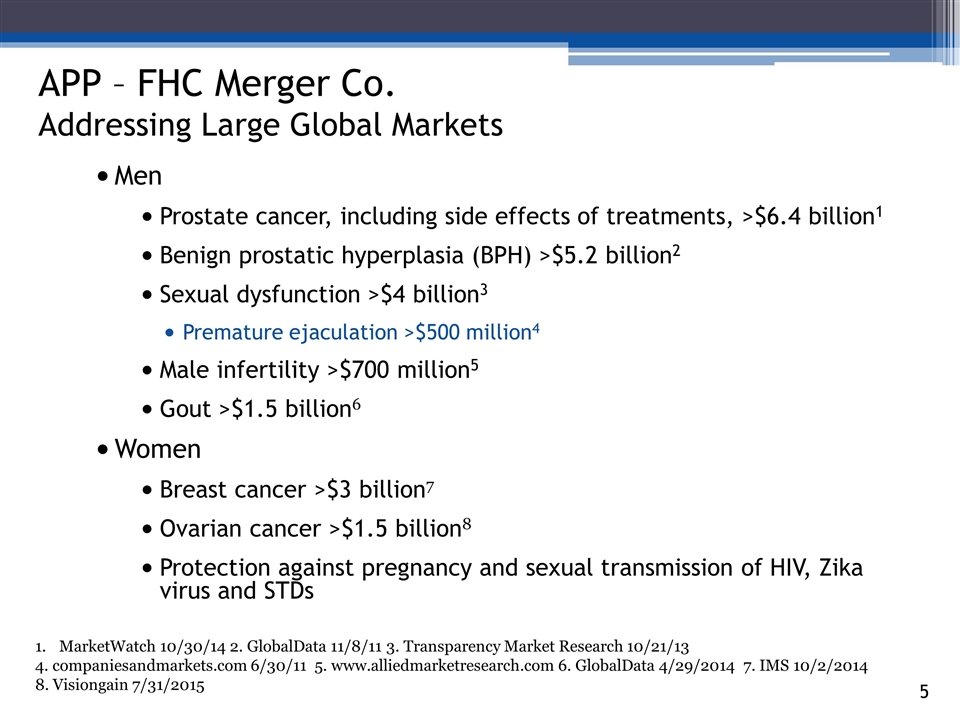

Men Prostate cancer, including side effects of treatments, >$6.4 billion1 Benign prostatic hyperplasia (BPH) >$5.2 billion2 Sexual dysfunction >$4 billion3 Premature ejaculation >$500 million4 Male infertility >$700 million5 Gout >$1.5 billion6 Women Breast cancer >$3 billion7 Ovarian cancer >$1.5 billion8 Protection against pregnancy and sexual transmission of HIV, Zika virus and STDs 3_85 APP – FHC Merger Co. Addressing Large Global Markets MarketWatch 10/30/14 2. GlobalData 11/8/11 3. Transparency Market Research 10/21/13 4. companiesandmarkets.com 6/30/11 5. www.alliedmarketresearch.com 6. GlobalData 4/29/2014 7. IMS 10/2/2014 8. Visiongain 7/31/2015

Combined portfolio of products and expertise establishes the new company as a leader in men’s and women’s health care Complementary diversification strategy with multiple shots on goal Deep value, opportunistic, late stage development and near term products for large markets Portfolio mostly less risky than other early-stage biopharmaceutical companies due to 505(b)(2) FDA pathway for a number of product candidates Experienced, dedicated leadership Women’s Health Division: Expand existing, profitable business; begin development of newly acquired oncology pharmaceutical products for breast and ovarian cancer Men’s Health Division: Create a business unit focused on male health, especially in the areas of benign prostatic hyperplasia, male infertility, hot flashes in men on prostate cancer therapy, gout and advanced prostate cancer; augment with the commercialization of consumer health products for premature ejaculation and sexual health vitamin supplements A financially strong company that is unique for this stage of development in that it has revenue and earnings, no debt, and is cash flow positive A multi-product portfolio of promising potential products to provide near and future upside to shareholders 3_85 APP - FHC Merger Co. Maximizes Both Short- and Long-Term Shareholder Value

Mitchell Steiner, MD – CEO and President. Urologist, Aspen Park Pharmaceuticals, OPKO Health, Inc. and GTx, Inc. Harry Fisch, MD – Chief Corporate Officer. Urologist, Aspen Park Pharmaceuticals and Millennium Sciences, Inc. Daniel Haines, CPA - Chief Financial Officer. E&Y, Equity One, Inc. (NYSE:EQY), OPKO Health (NYSE:OPK) and Lennar Corp (NYSE:LEN) Expected to join at closing: Chief Medical Officer VP Clinical Development VP of Chemistry, Manufacturing, and Controls 3_81 Experienced Management Team for APP-FHC Merger Co. Clinical and Industry Expertise

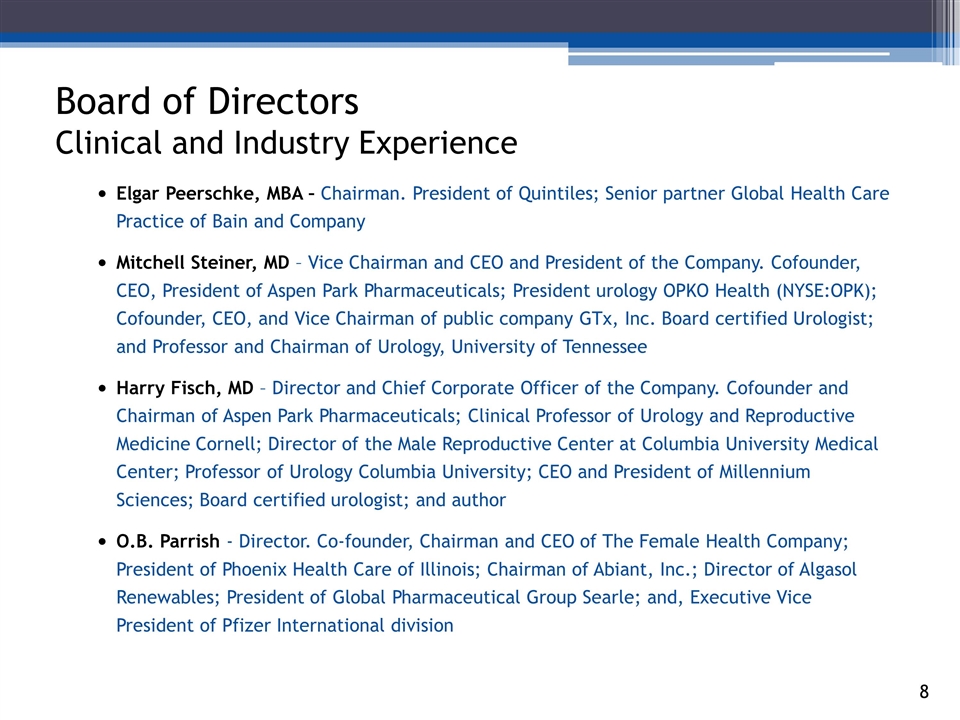

Elgar Peerschke, MBA – Chairman. President of Quintiles; Senior partner Global Health Care Practice of Bain and Company Mitchell Steiner, MD – Vice Chairman and CEO and President of the Company. Cofounder, CEO, President of Aspen Park Pharmaceuticals; President urology OPKO Health (NYSE:OPK); Cofounder, CEO, and Vice Chairman of public company GTx, Inc. Board certified Urologist; and Professor and Chairman of Urology, University of Tennessee Harry Fisch, MD – Director and Chief Corporate Officer of the Company. Cofounder and Chairman of Aspen Park Pharmaceuticals; Clinical Professor of Urology and Reproductive Medicine Cornell; Director of the Male Reproductive Center at Columbia University Medical Center; Professor of Urology Columbia University; CEO and President of Millennium Sciences; Board certified urologist; and author O.B. Parrish - Director. Co-founder, Chairman and CEO of The Female Health Company; President of Phoenix Health Care of Illinois; Chairman of Abiant, Inc.; Director of Algasol Renewables; President of Global Pharmaceutical Group Searle; and, Executive Vice President of Pfizer International division 3_81 Board of Directors Clinical and Industry Experience

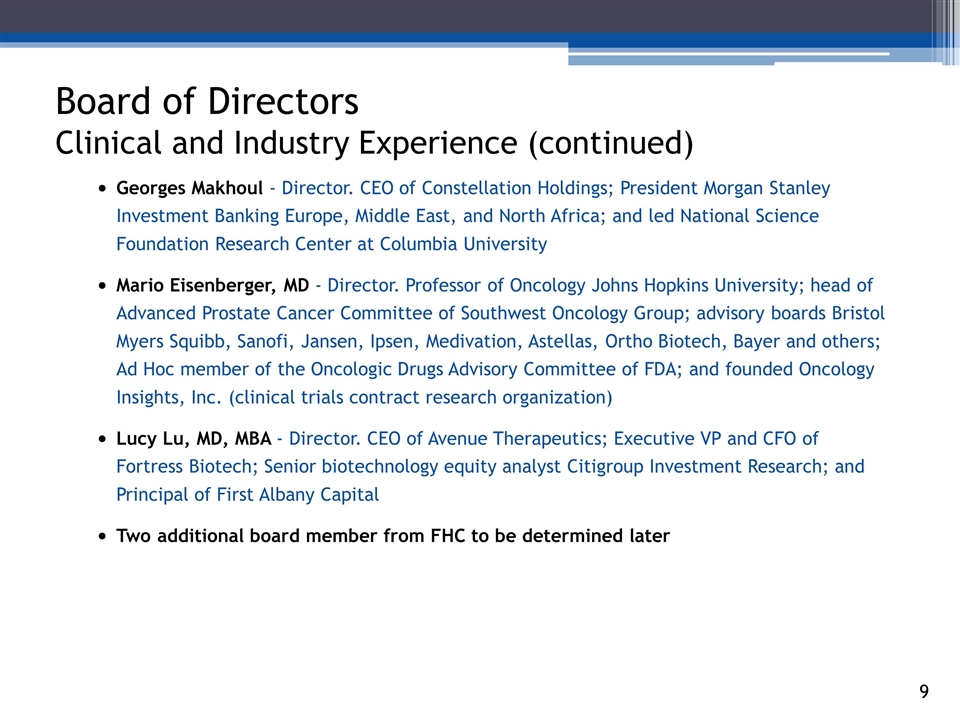

Georges Makhoul - Director. CEO of Constellation Holdings; President Morgan Stanley Investment Banking Europe, Middle East, and North Africa; and led National Science Foundation Research Center at Columbia University Mario Eisenberger, MD - Director. Professor of Oncology Johns Hopkins University; head of Advanced Prostate Cancer Committee of Southwest Oncology Group; advisory boards Bristol Myers Squibb, Sanofi, Jansen, Ipsen, Medivation, Astellas, Ortho Biotech, Bayer and others; Ad Hoc member of the Oncologic Drugs Advisory Committee of FDA; and founded Oncology Insights, Inc. (clinical trials contract research organization) Lucy Lu, MD, MBA - Director. CEO of Avenue Therapeutics; Executive VP and CFO of Fortress Biotech; Senior biotechnology equity analyst Citigroup Investment Research; and Principal of First Albany Capital Two additional board member from FHC to be determined later 3_81 Board of Directors Clinical and Industry Experience (continued)

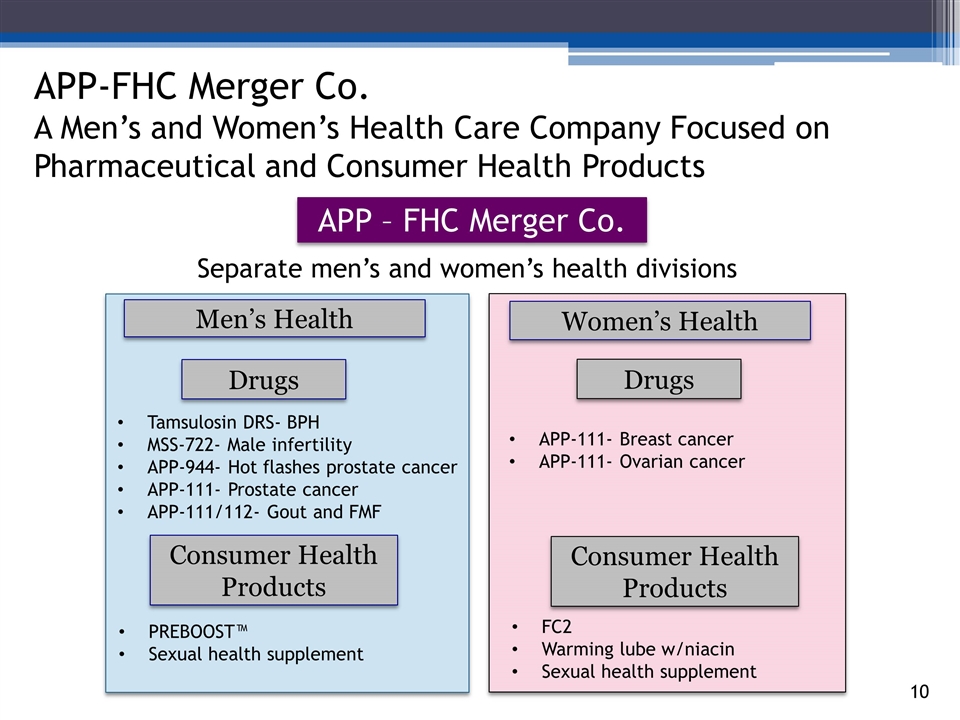

3_85 APP-FHC Merger Co. A Men’s and Women’s Health Care Company Focused on Pharmaceutical and Consumer Health Products APP – FHC Merger Co. Women’s Health Men’s Health Tamsulosin DRS- BPH MSS-722- Male infertility APP-944- Hot flashes prostate cancer APP-111- Prostate cancer APP-111/112- Gout and FMF APP-111- Breast cancer APP-111- Ovarian cancer PREBOOST™ Sexual health supplement FC2 Warming lube w/niacin Sexual health supplement Drugs Consumer Health Products Separate men’s and women’s health divisions Drugs Consumer Health Products

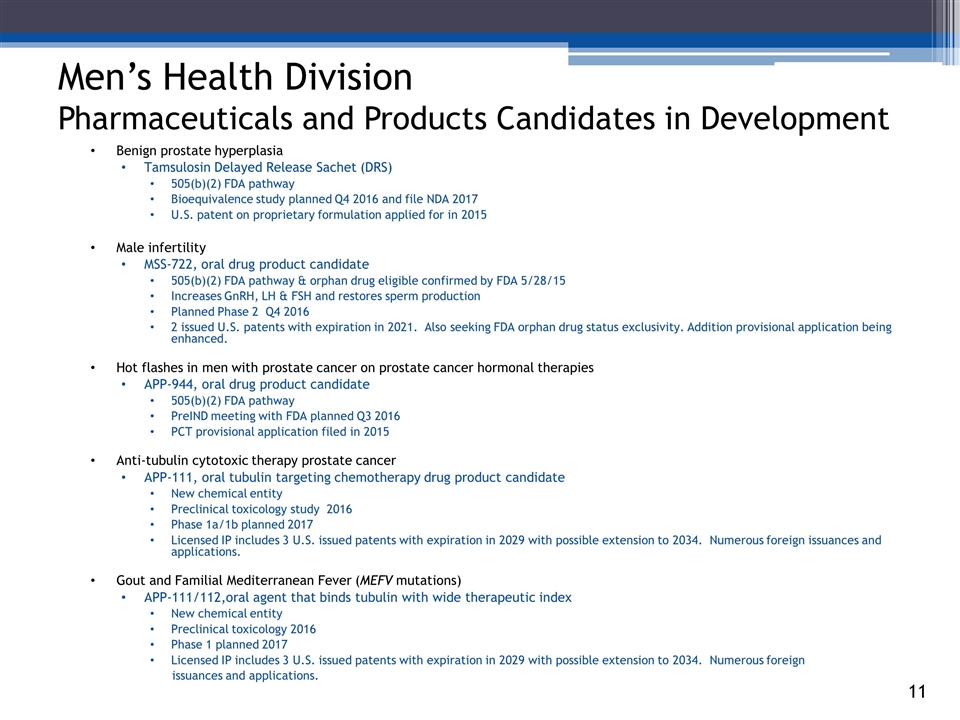

Men’s Health Division Pharmaceuticals and Products Candidates in Development Benign prostate hyperplasia Tamsulosin Delayed Release Sachet (DRS) 505(b)(2) FDA pathway Bioequivalence study planned Q4 2016 and file NDA 2017 U.S. patent on proprietary formulation applied for in 2015 Male infertility MSS-722, oral drug product candidate 505(b)(2) FDA pathway & orphan drug eligible confirmed by FDA 5/28/15 Increases GnRH, LH & FSH and restores sperm production Planned Phase 2 Q4 2016 2 issued U.S. patents with expiration in 2021. Also seeking FDA orphan drug status exclusivity. Addition provisional application being enhanced. Hot flashes in men with prostate cancer on prostate cancer hormonal therapies APP-944, oral drug product candidate 505(b)(2) FDA pathway PreIND meeting with FDA planned Q3 2016 PCT provisional application filed in 2015 Anti-tubulin cytotoxic therapy prostate cancer APP-111, oral tubulin targeting chemotherapy drug product candidate New chemical entity Preclinical toxicology study 2016 Phase 1a/1b planned 2017 Licensed IP includes 3 U.S. issued patents with expiration in 2029 with possible extension to 2034. Numerous foreign issuances and applications. Gout and Familial Mediterranean Fever (MEFV mutations) APP-111/112,oral agent that binds tubulin with wide therapeutic index New chemical entity Preclinical toxicology 2016 Phase 1 planned 2017 Licensed IP includes 3 U.S. issued patents with expiration in 2029 with possible extension to 2034. Numerous foreign issuances and applications. 3_85

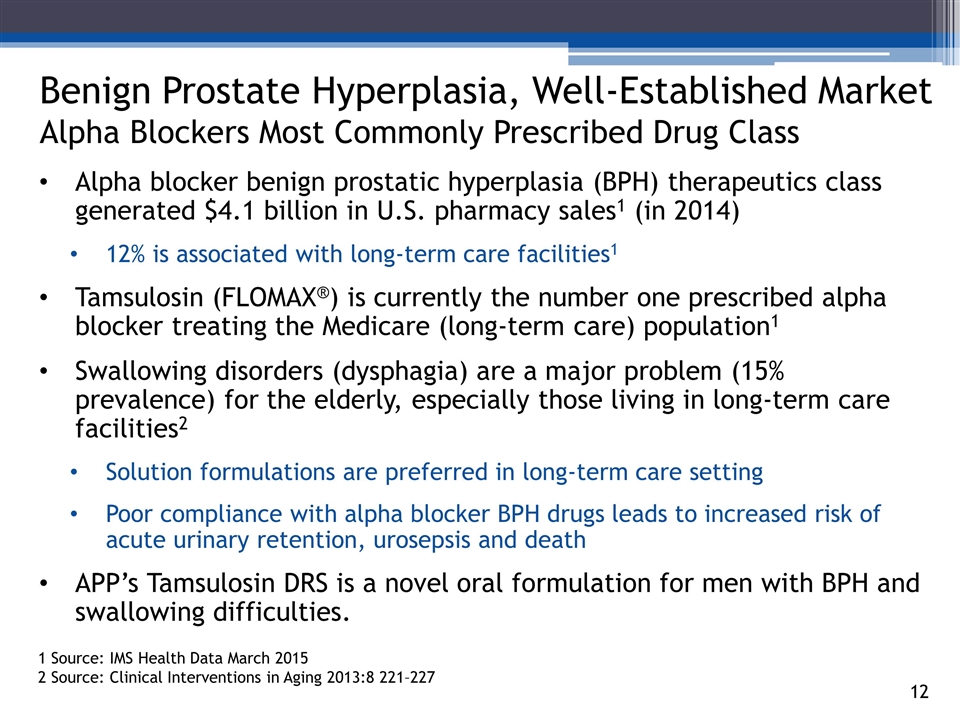

Alpha blocker benign prostatic hyperplasia (BPH) therapeutics class generated $4.1 billion in U.S. pharmacy sales1 (in 2014) 12% is associated with long-term care facilities1 Tamsulosin (FLOMAX®) is currently the number one prescribed alpha blocker treating the Medicare (long-term care) population1 Swallowing disorders (dysphagia) are a major problem (15% prevalence) for the elderly, especially those living in long-term care facilities2 Solution formulations are preferred in long-term care setting Poor compliance with alpha blocker BPH drugs leads to increased risk of acute urinary retention, urosepsis and death APP’s Tamsulosin DRS is a novel oral formulation for men with BPH and swallowing difficulties. 3_85 Benign Prostate Hyperplasia, Well-Established Market Alpha Blockers Most Commonly Prescribed Drug Class 1 Source: IMS Health Data March 2015 2 Source: Clinical Interventions in Aging 2013:8 221–227

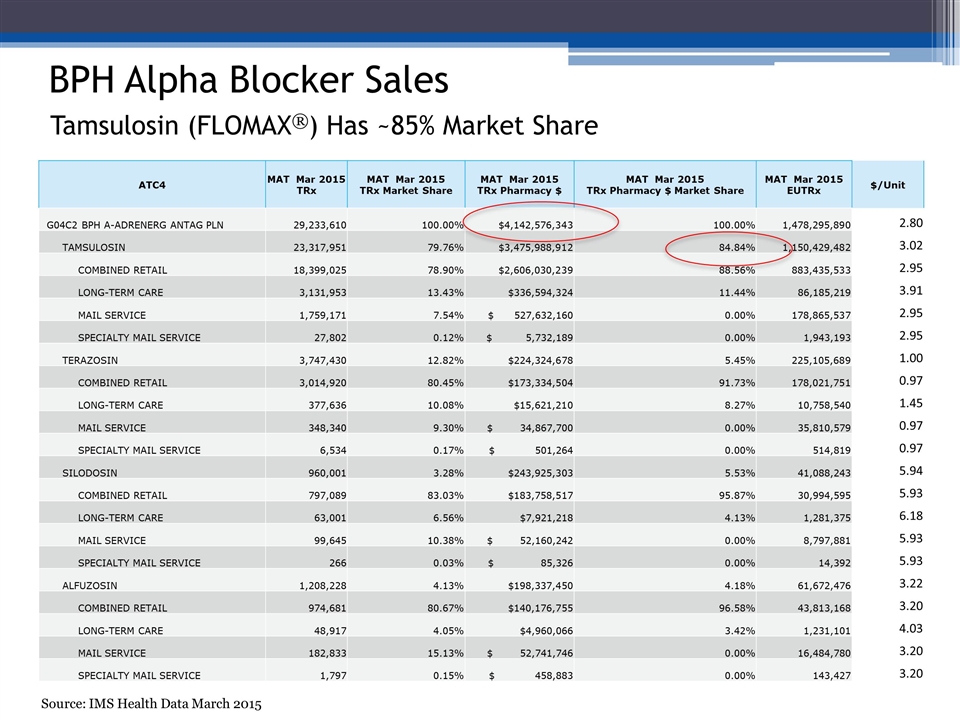

BPH Alpha Blocker Sales Tamsulosin (FLOMAX®) Has ~85% Market Share ATC4 MAT Mar 2015 TRx MAT Mar 2015 TRx Market Share MAT Mar 2015 TRx Pharmacy $ MAT Mar 2015 TRx Pharmacy $ Market Share MAT Mar 2015 EUTRx $/Unit G04C2 BPH A-ADRENERG ANTAG PLN 29,233,610 100.00% $4,142,576,343 100.00% 1,478,295,890 2.80 TAMSULOSIN 23,317,951 79.76% $3,475,988,912 84.84% 1,150,429,482 3.02 COMBINED RETAIL 18,399,025 78.90% $2,606,030,239 88.56% 883,435,533 2.95 LONG-TERM CARE 3,131,953 13.43% $336,594,324 11.44% 86,185,219 3.91 MAIL SERVICE 1,759,171 7.54% $ 527,632,160 0.00% 178,865,537 2.95 SPECIALTY MAIL SERVICE 27,802 0.12% $ 5,732,189 0.00% 1,943,193 2.95 TERAZOSIN 3,747,430 12.82% $224,324,678 5.45% 225,105,689 1.00 COMBINED RETAIL 3,014,920 80.45% $173,334,504 91.73% 178,021,751 0.97 LONG-TERM CARE 377,636 10.08% $15,621,210 8.27% 10,758,540 1.45 MAIL SERVICE 348,340 9.30% $ 34,867,700 0.00% 35,810,579 0.97 SPECIALTY MAIL SERVICE 6,534 0.17% $ 501,264 0.00% 514,819 0.97 SILODOSIN 960,001 3.28% $243,925,303 5.53% 41,088,243 5.94 COMBINED RETAIL 797,089 83.03% $183,758,517 95.87% 30,994,595 5.93 LONG-TERM CARE 63,001 6.56% $7,921,218 4.13% 1,281,375 6.18 MAIL SERVICE 99,645 10.38% $ 52,160,242 0.00% 8,797,881 5.93 SPECIALTY MAIL SERVICE 266 0.03% $ 85,326 0.00% 14,392 5.93 ALFUZOSIN 1,208,228 4.13% $198,337,450 4.18% 61,672,476 3.22 COMBINED RETAIL 974,681 80.67% $140,176,755 96.58% 43,813,168 3.20 LONG-TERM CARE 48,917 4.05% $4,960,066 3.42% 1,231,101 4.03 MAIL SERVICE 182,833 15.13% $ 52,741,746 0.00% 16,484,780 3.20 SPECIALTY MAIL SERVICE 1,797 0.15% $ 458,883 0.00% 143,427 3.20 Source: IMS Health Data March 2015

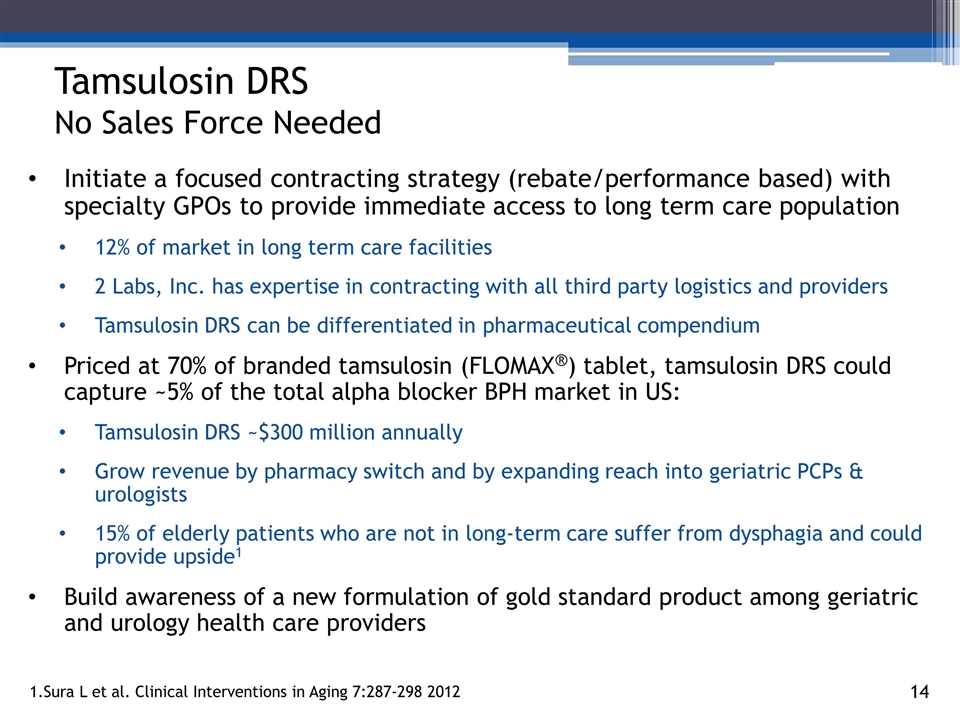

Initiate a focused contracting strategy (rebate/performance based) with specialty GPOs to provide immediate access to long term care population 12% of market in long term care facilities 2 Labs, Inc. has expertise in contracting with all third party logistics and providers Tamsulosin DRS can be differentiated in pharmaceutical compendium Priced at 70% of branded tamsulosin (FLOMAX®) tablet, tamsulosin DRS could capture ~5% of the total alpha blocker BPH market in US: Tamsulosin DRS ~$300 million annually Grow revenue by pharmacy switch and by expanding reach into geriatric PCPs & urologists 15% of elderly patients who are not in long-term care suffer from dysphagia and could provide upside1 Build awareness of a new formulation of gold standard product among geriatric and urology health care providers 3_85 Tamsulosin DRS No Sales Force Needed 1.Sura L et al. Clinical Interventions in Aging 7:287-298 2012

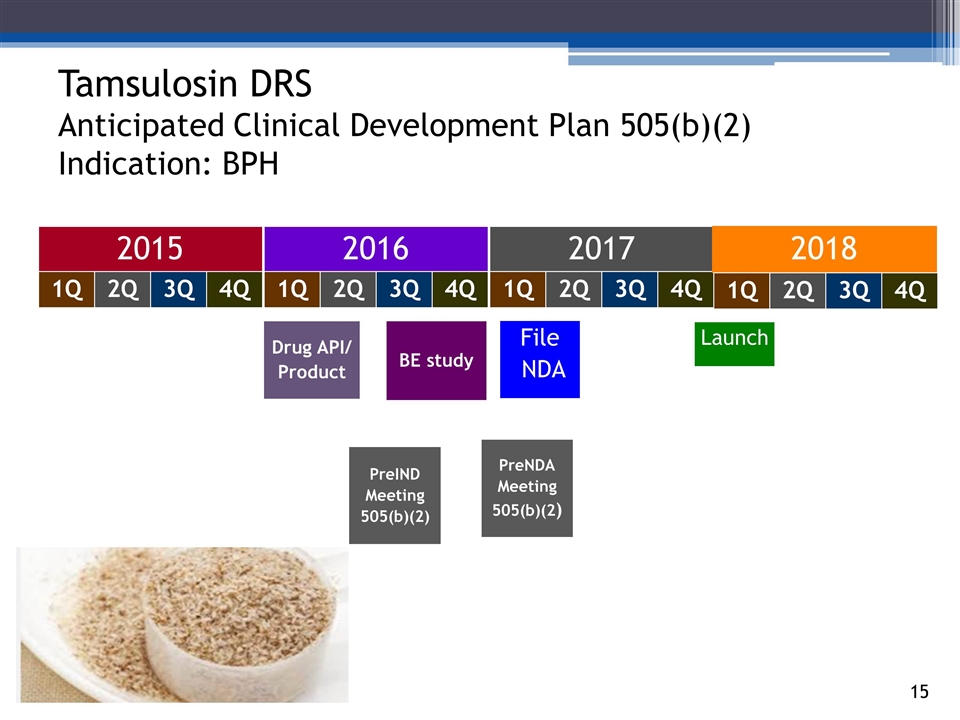

Drug API/ Product Tamsulosin DRS Anticipated Clinical Development Plan 505(b)(2) Indication: BPH 2015 2016 2017 BE study 140294_84 3_84 4_84 48_84 65_84 70_84 2Q 1Q 3Q 4Q 2Q 1Q 3Q 4Q 2Q 1Q 3Q 4Q PreIND Meeting 505(b)(2) File NDA 2018 2Q 1Q 3Q 4Q PreNDA Meeting 505(b)(2) Launch

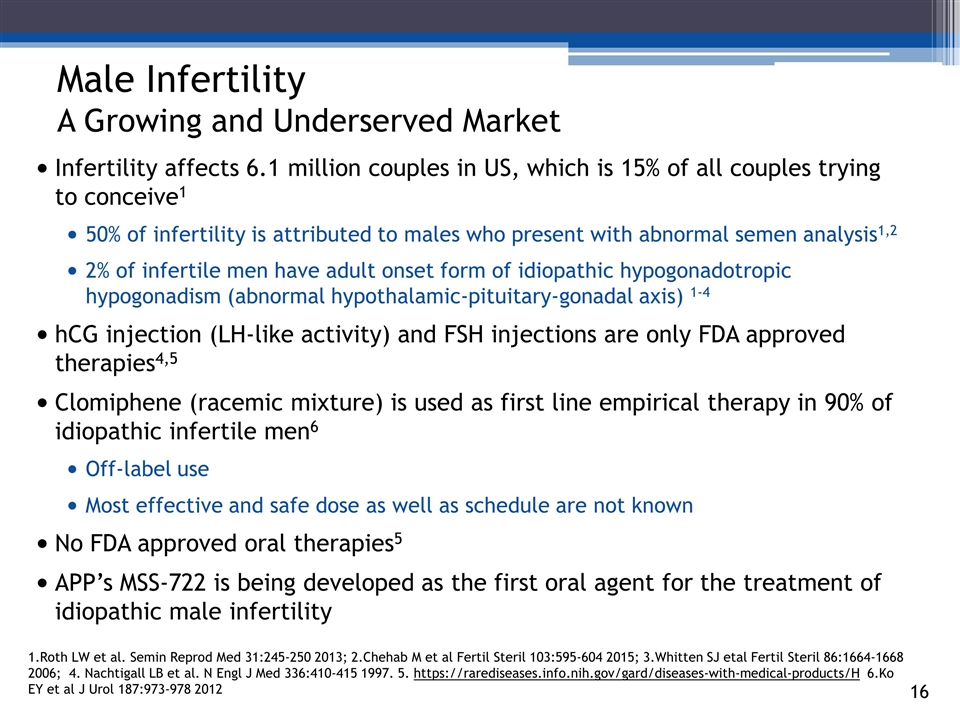

Male Infertility A Growing and Underserved Market Infertility affects 6.1 million couples in US, which is 15% of all couples trying to conceive1 50% of infertility is attributed to males who present with abnormal semen analysis1,2 2% of infertile men have adult onset form of idiopathic hypogonadotropic hypogonadism (abnormal hypothalamic-pituitary-gonadal axis) 1-4 hCG injection (LH-like activity) and FSH injections are only FDA approved therapies4,5 Clomiphene (racemic mixture) is used as first line empirical therapy in 90% of idiopathic infertile men6 Off-label use Most effective and safe dose as well as schedule are not known No FDA approved oral therapies5 APP’s MSS-722 is being developed as the first oral agent for the treatment of idiopathic male infertility 3_85 1.Roth LW et al. Semin Reprod Med 31:245-250 2013; 2.Chehab M et al Fertil Steril 103:595-604 2015; 3.Whitten SJ etal Fertil Steril 86:1664-1668 2006; 4. Nachtigall LB et al. N Engl J Med 336:410-415 1997. 5. https://rarediseases.info.nih.gov/gard/diseases-with-medical-products/H 6.Ko EY et al J Urol 187:973-978 2012

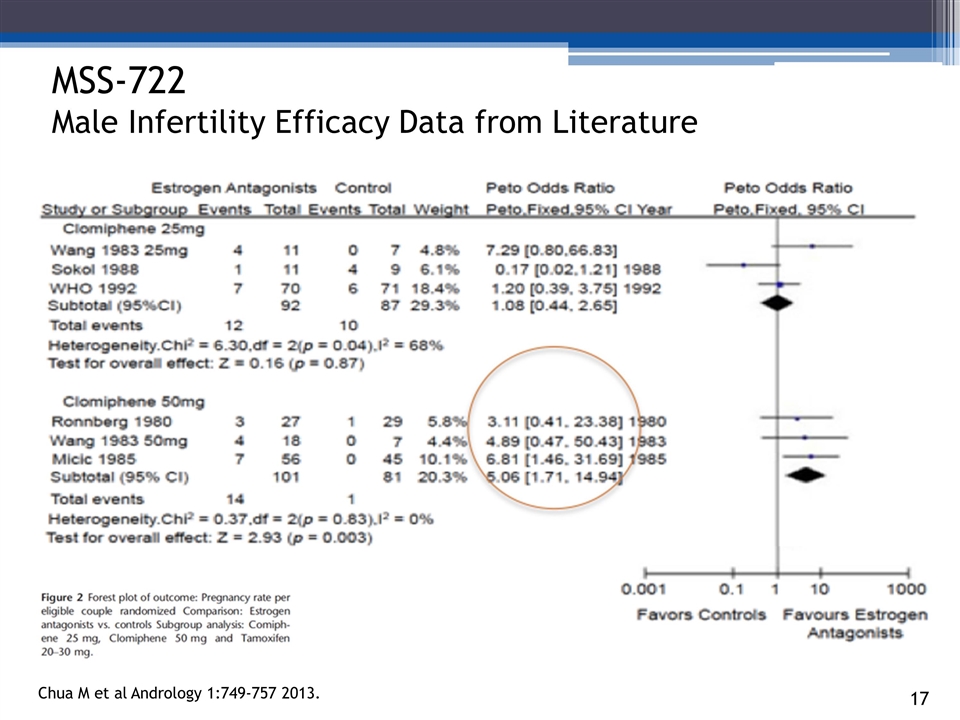

18_85 11_84 MSS-722 Male Infertility Efficacy Data from Literature Efficacy Chua M et al Andrology 1:749-757 2013.

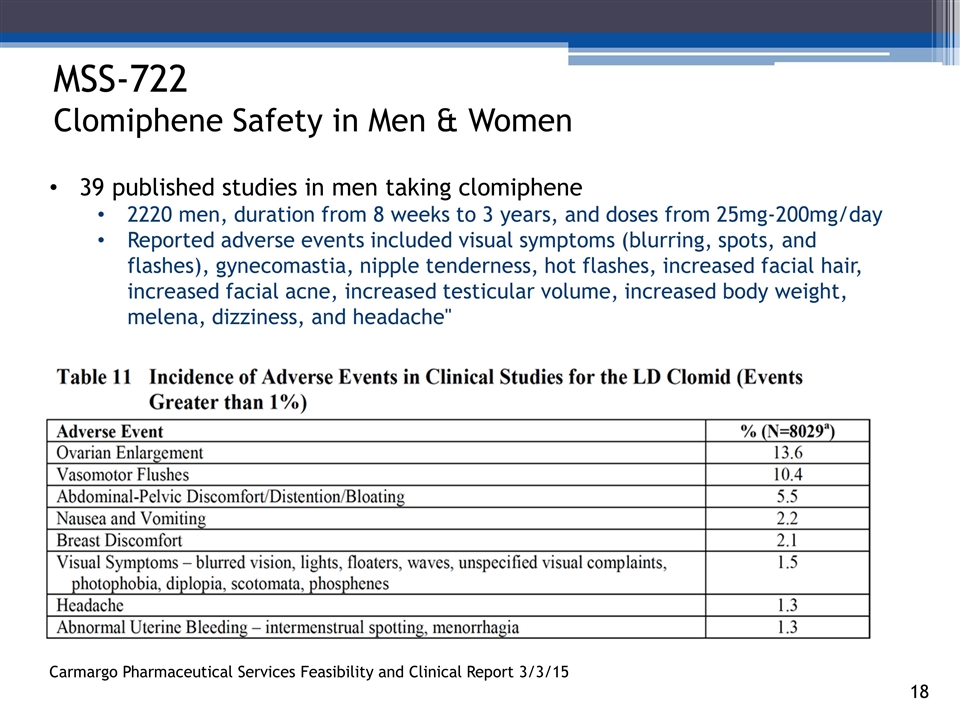

18_85 11_84 MSS-722 Clomiphene Safety in Men & Women Carmargo Pharmaceutical Services Feasibility and Clinical Report 3/3/15 39 published studies in men taking clomiphene 2220 men, duration from 8 weeks to 3 years, and doses from 25mg-200mg/day Reported adverse events included visual symptoms (blurring, spots, and flashes), gynecomastia, nipple tenderness, hot flashes, increased facial hair, increased facial acne, increased testicular volume, increased body weight, melena, dizziness, and headache"

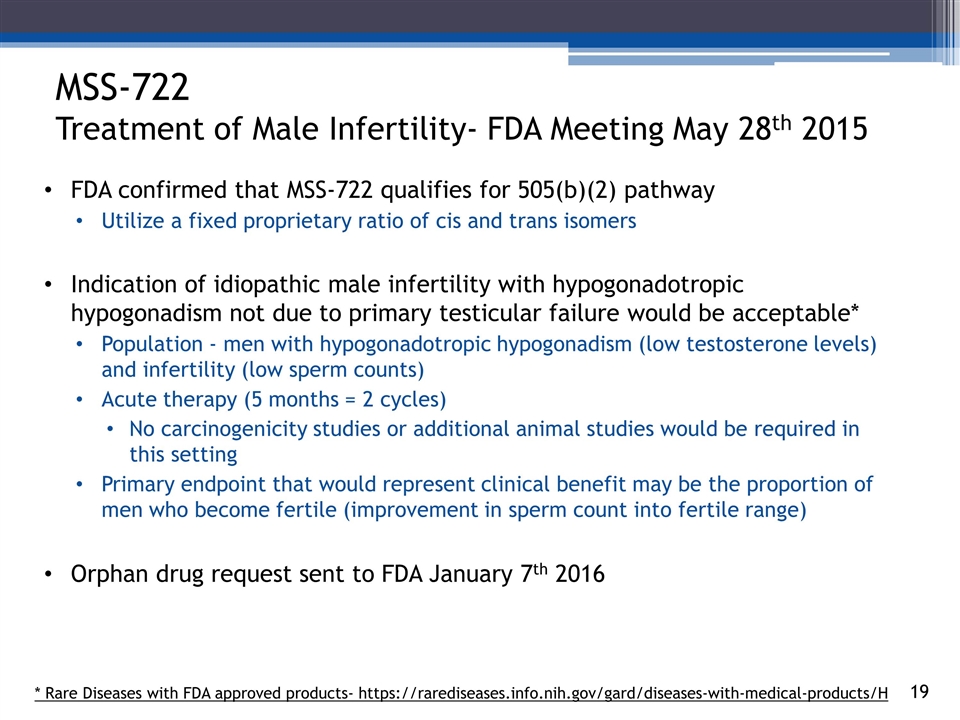

FDA confirmed that MSS-722 qualifies for 505(b)(2) pathway Utilize a fixed proprietary ratio of cis and trans isomers Indication of idiopathic male infertility with hypogonadotropic hypogonadism not due to primary testicular failure would be acceptable* Population - men with hypogonadotropic hypogonadism (low testosterone levels) and infertility (low sperm counts) Acute therapy (5 months = 2 cycles) No carcinogenicity studies or additional animal studies would be required in this setting Primary endpoint that would represent clinical benefit may be the proportion of men who become fertile (improvement in sperm count into fertile range) Orphan drug request sent to FDA January 7th 2016 18_85 11_84 MSS-722 Treatment of Male Infertility- FDA Meeting May 28th 2015 * Rare Diseases with FDA approved products- https://rarediseases.info.nih.gov/gard/diseases-with-medical-products/H

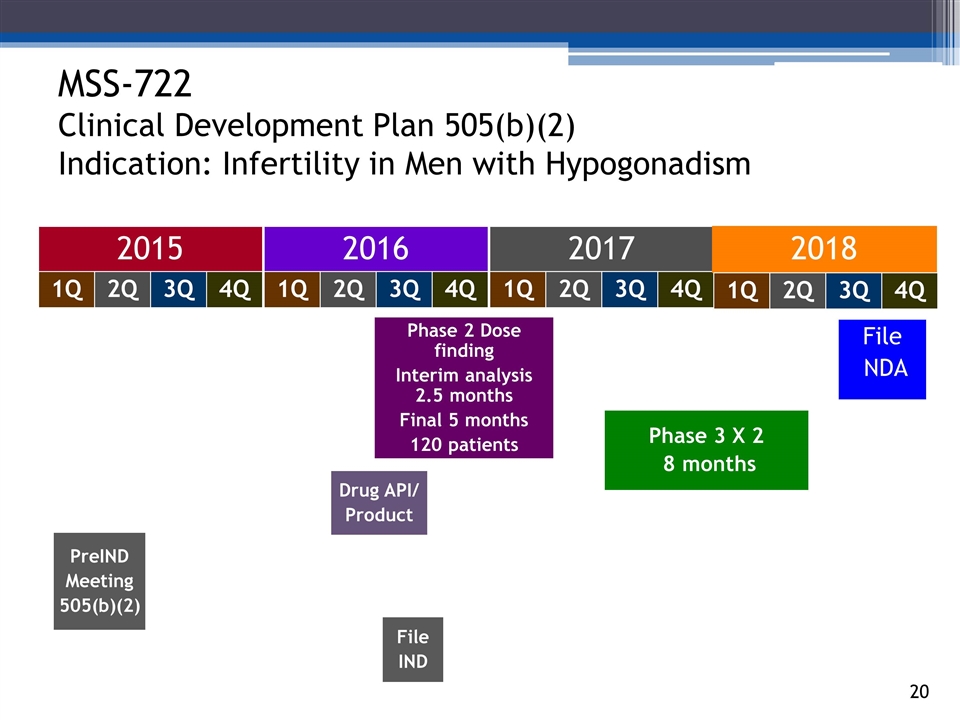

Drug API/ Product MSS-722 Clinical Development Plan 505(b)(2) Indication: Infertility in Men with Hypogonadism 2015 2016 2017 Phase 2 Dose finding Interim analysis 2.5 months Final 5 months 120 patients 140294_84 3_84 4_84 48_84 65_84 70_84 2Q 1Q 3Q 4Q 2Q 1Q 3Q 4Q 2Q 1Q 3Q 4Q Phase 3 X 2 8 months PreIND Meeting 505(b)(2) File IND File NDA 2018 2Q 1Q 3Q 4Q

18_85 11_84 APP-944 Oral Drug Product for the Treatment of Hot Flashes in Men on Prostate Cancer Hormonal Therapy Hot flashes are the most common and distressing side effect of androgen deprivation therapy and other hormone therapies for prostate cancer Up to 80% of men treated with hormone therapies experience hot flashes Abiraterone and enzalutamide exacerbate hot flashes Currently, no FDA approved therapies to treat hot flashes in men on prostate cancer hormonal therapies 505(b)(2) pathway Market 700,000 men on androgen deprivation therapy in the US 30% penetration = 255,000 men translates to $700 million/year Gomella LG et al BJU Int S1:25-29 2007; Karling P, et al. J Urol 152:1170-1173 1994

APP-111 Oral Novel Tubulin Targeting Chemotherapy for Advanced Prostate Cancer 4_81 $5 billion market for secondary hormone therapies for prostate cancer1 and $4.8B market for taxanes & vinca alkaloids (Docetaxel $1B & cabazitaxel $500 million in prostate cancer)2 Emerging Indications: Secondary hormone therapies like enzalutamide and abiraterone/prednisone have almost complete cross resistance and should not be used in sequence in advanced prostate cancer3 Androgen deprivation therapy and docetaxel increase survival in men with hormone sensitive prostate cancer and high volume disease4 Agents that target tubulin have been the only effective cytotoxic chemotherapy in advanced prostate cancer, but there are challenges5: Drug resistance is common – multidrug resistance proteins, tubulin mutations and overexpression Safety concerns - hypersensitivity reactions, myelosuppression, and neurotoxicity (peripheral neuropathy & muscle weakness) Route of administration-only available as IV dosing 1.MarketWatch 10/30/14; 2. Dimopoulos G Seeking Alpha 11/14/12; 3. Omlin A et al Therapeutic Advances in Urology 6:3-14 2014; 4. Sweeney C et al J Clin Oncol 32:5s 2014; 5.Diamond E et al Curr Treat Options Oncol 16:9 2015

APP-111 Oral Novel Tubulin Targeting Chemotherapy 4_81 Proof-of-concept preclinical studies were successful. We have a drug!! Low nanomolar tubulin inhibition Binds to colchicine site of tubulin High oral bioavailability High brain penetration Not substrate MDRs (P-gp, MRPs, and BCRP) Not substrate for CYP3A4 Demonstrated activity against taxane-, vinca alkaloid- and doxorubicin-refractory cancers High activity against many cancer types including prostate cancer in vitro and in vivo Favorable safety profile (less neurotoxicity & leukopenia) Over 28 peer-reviewed publications

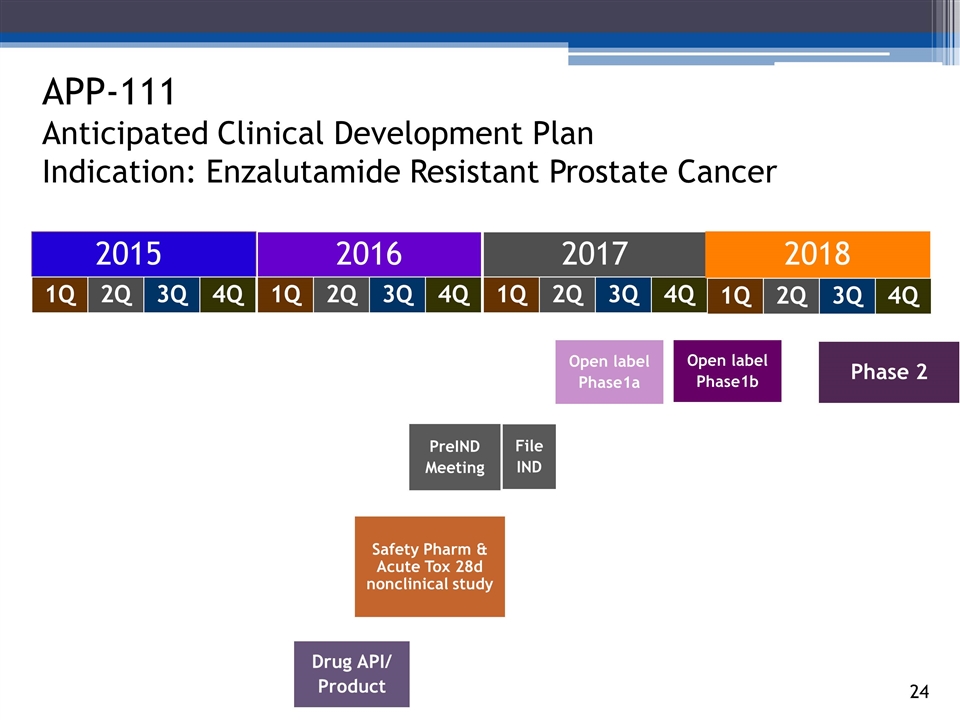

APP-111 Anticipated Clinical Development Plan Indication: Enzalutamide Resistant Prostate Cancer 2015 2016 2017 140294_84 3_84 4_84 48_84 65_84 70_84 2Q 1Q 3Q 4Q 2Q 1Q 3Q 4Q 2Q 1Q 3Q 4Q 2018 2Q 1Q 3Q 4Q Drug API/ Product Open label Phase1a Phase 2 PreIND Meeting File IND Safety Pharm & Acute Tox 28d nonclinical study Open label Phase1b

APP-111- Potential Platform Technology IV Anti-tubulins Have Demonstrated Activity Against a Broad Group of Tumor Types Vinca Alkaloids – primarily used in combination chemotherapy (ABVD, Stanford-V, CHOP, MOPP) for hematologic malignancies (leukemia, lymphoma, myeloma, sarcoma), and some neuroblastoma, thyroid cancer, and NSCLC Vinblastine (Velban®) Vincristine (Oncovin®) Vinorelbine (Navelbine®) Taxanes – primarily used for solid tumors such as breast, ovarian, endometrial, cervical, lung, head and neck, esophageal , bladder, gastric, and prostate Paclitaxel (Taxol®) Docetaxel (Taxotere®) Cabazitaxel (Jevtana®)

Gout is a type of arthritis characterized by sudden, severe attacks of joint pain because of the deposition of uric acid crystals in the joints Gout is 10x more common in men than women In the US, 8.3 million people with gout and the incidence is increasing Global market for gout drugs exceeds $1.5 billion 3_85 Gout is the Most Common Form of Inflammatory Arthritis in Men Over 40 Years of Age

Colchicine is effective to treat and to prevent acute attacks, but has side effects such as abdominal cramping, nausea, and diarrhea Low therapeutic index (low safety margin) Drug-drug interactions are common APP-111/112 is an oral, novel small molecule that binds to same drug target site as colchicine, but potentially better safety profile No drug-drug interactions, with potentially wide therapeutic index (wider safety margin) 3_85 Current Gout Therapy Effective, But …

Men’s Health Division Consumer Health Products Reducing the incidence of premature ejaculation PREBOOST® OTC product Desensitizing individual wipes FDA approved (compliant with FDA OTC monograph) Phase 4 to be completed in 2016 Market launch Q3 2016 Sexual health vitamin supplement Special formulation to promote male sexual health 3_85

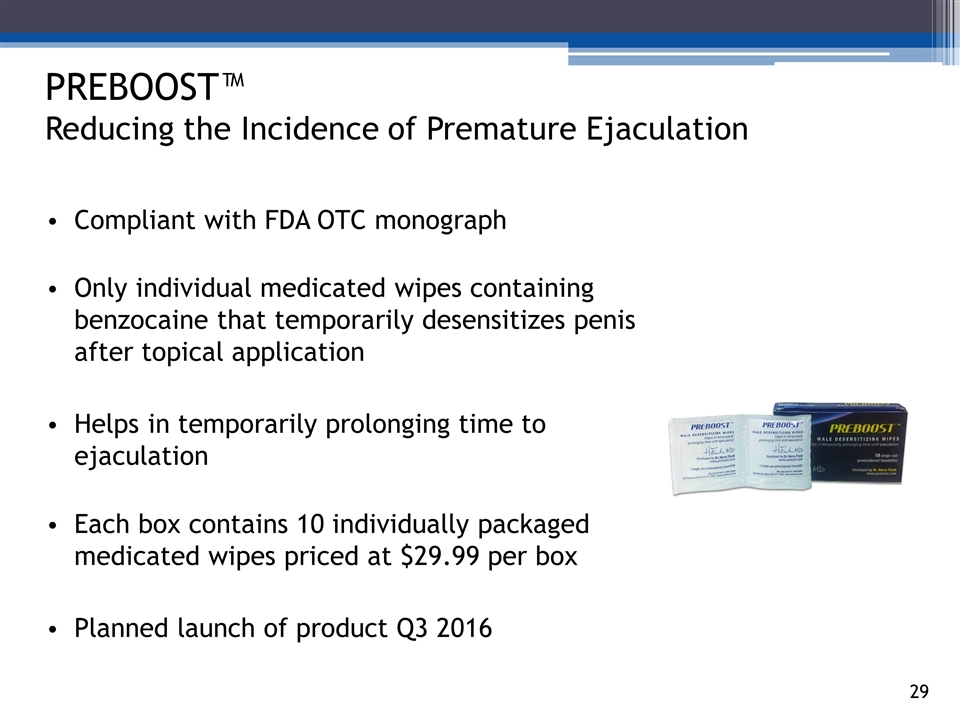

18_85 11_84 PREBOOST™ Reducing the Incidence of Premature Ejaculation Compliant with FDA OTC monograph Only individual medicated wipes containing benzocaine that temporarily desensitizes penis after topical application Helps in temporarily prolonging time to ejaculation Each box contains 10 individually packaged medicated wipes priced at $29.99 per box Planned launch of product Q3 2016

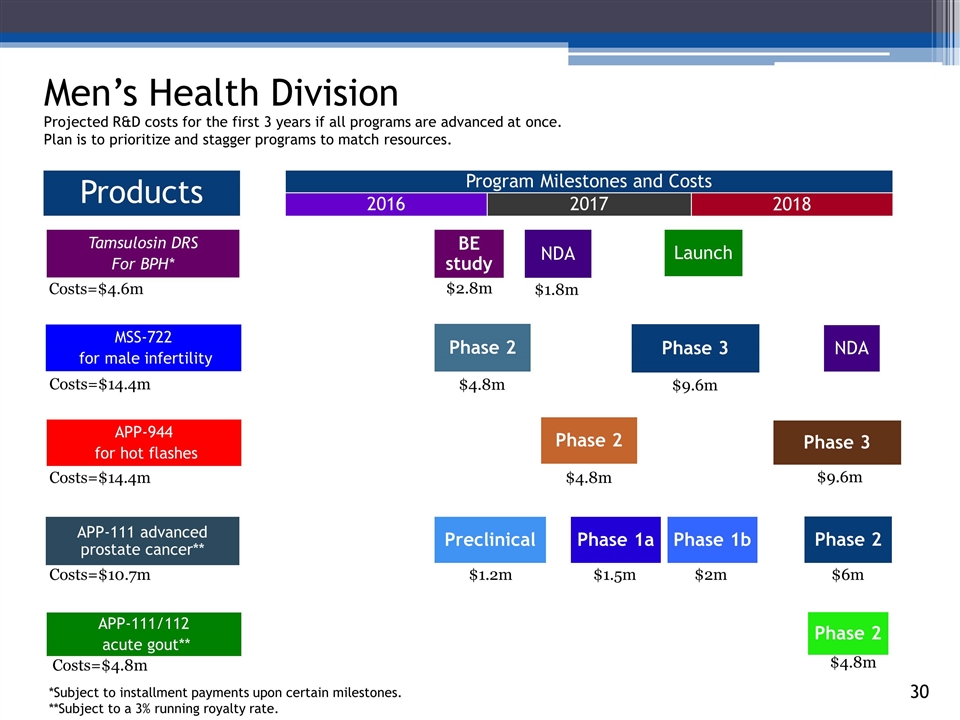

Men’s Health Division 2016 2017 140294_84 3_84 4_84 48_84 65_84 70_84 2018 Products APP-111 advanced prostate cancer** Phase 1a Phase 2 Tamsulosin DRS For BPH* Phase 1b BE study NDA Launch MSS-722 for male infertility NDA Phase 2 Phase 3 APP-944 for hot flashes Phase 2 Phase 3 APP-111/112 acute gout** Phase 2 Costs=$4.6m Costs=$14.4m Costs=$14.4m Costs=$4.8m Costs=$10.7m $2.8m $4.8m $9.6m $9.6m $4.8m $1.5m $2m $6m $4.8m Preclinical $1.2m Projected R&D costs for the first 3 years if all programs are advanced at once. Plan is to prioritize and stagger programs to match resources. $1.8m Program Milestones and Costs *Subject to installment payments upon certain milestones. **Subject to a 3% running royalty rate.

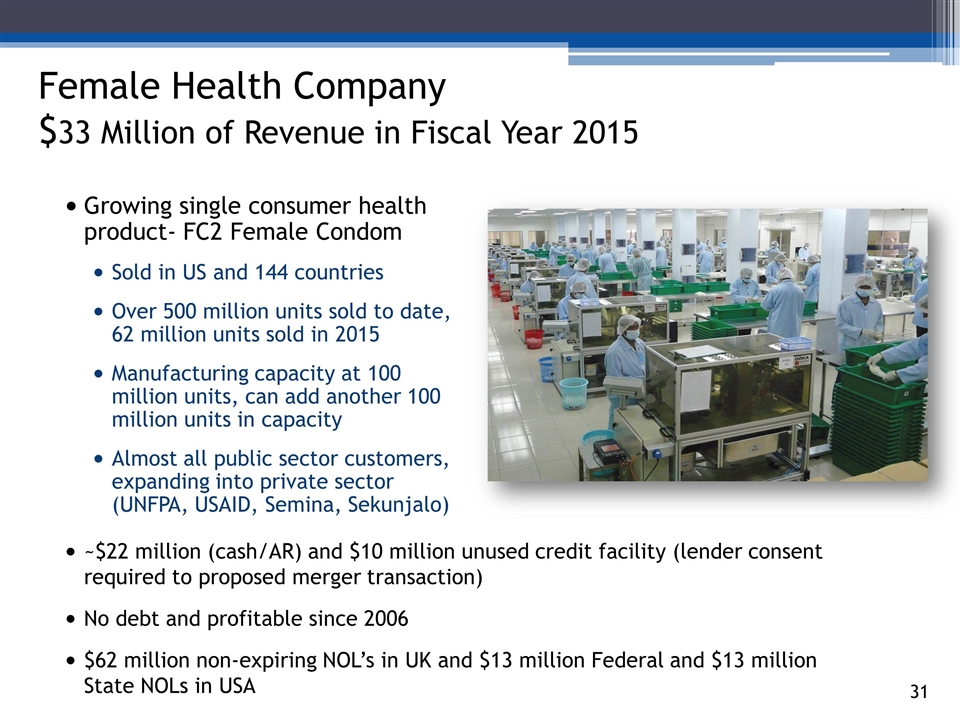

Growing single consumer health product- FC2 Female Condom Sold in US and 144 countries Over 500 million units sold to date, 62 million units sold in 2015 Manufacturing capacity at 100 million units, can add another 100 million units in capacity Almost all public sector customers, expanding into private sector (UNFPA, USAID, Semina, Sekunjalo) 3_85 Female Health Company $33 Million of Revenue in Fiscal Year 2015 ~$22 million (cash/AR) and $10 million unused credit facility (lender consent required to proposed merger transaction) No debt and profitable since 2006 $62 million non-expiring NOL’s in UK and $13 million Federal and $13 million State NOLs in USA

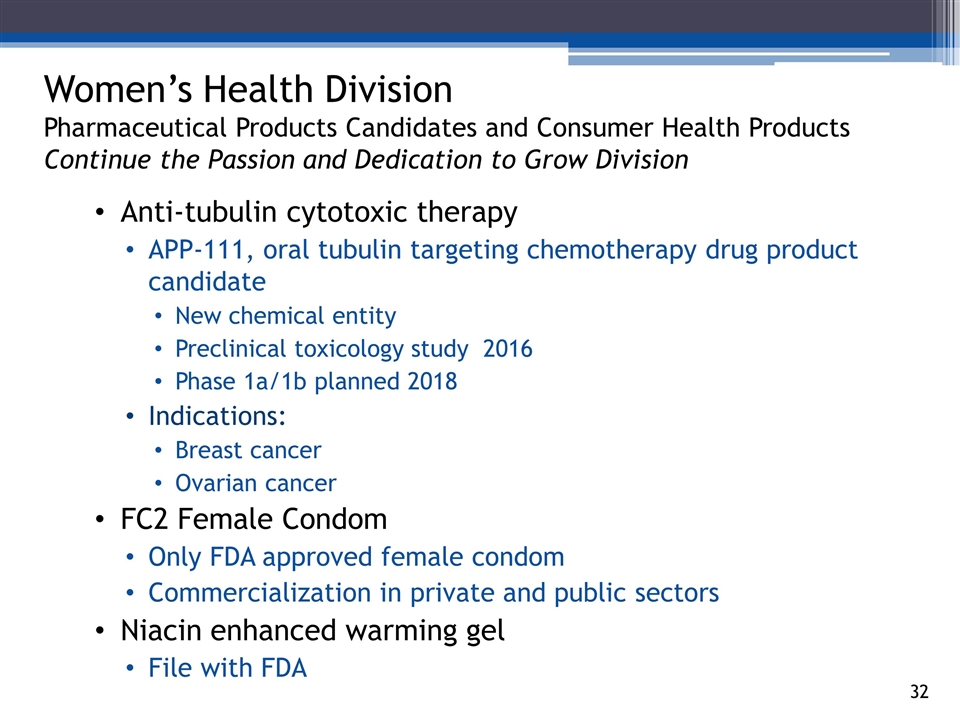

Women’s Health Division Pharmaceutical Products Candidates and Consumer Health Products Continue the Passion and Dedication to Grow Division Anti-tubulin cytotoxic therapy APP-111, oral tubulin targeting chemotherapy drug product candidate New chemical entity Preclinical toxicology study 2016 Phase 1a/1b planned 2018 Indications: Breast cancer Ovarian cancer FC2 Female Condom Only FDA approved female condom Commercialization in private and public sectors Niacin enhanced warming gel File with FDA 3_85

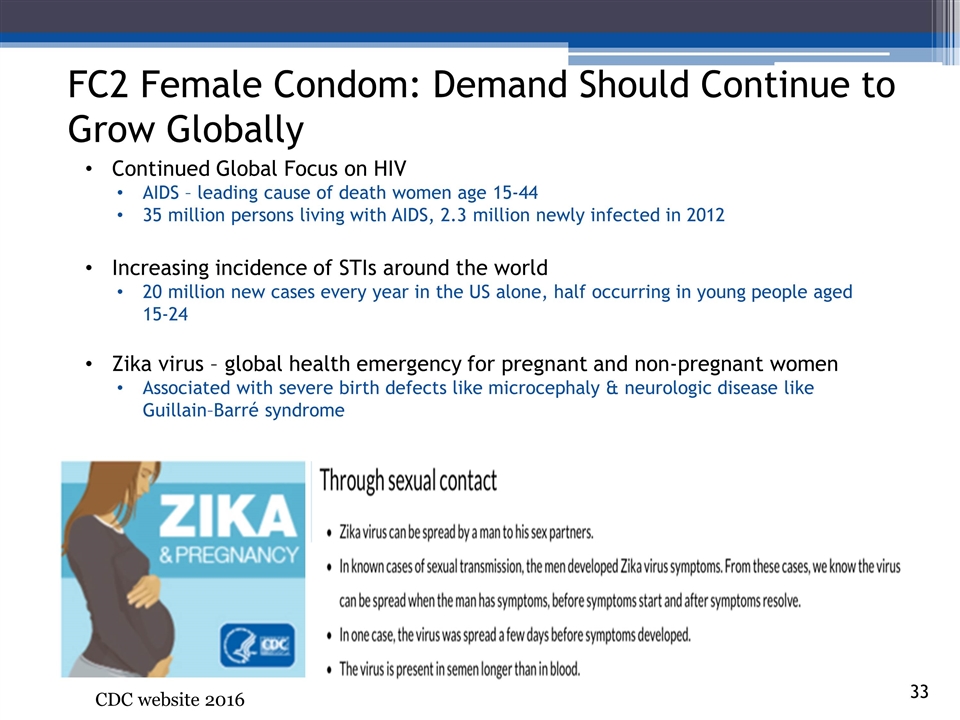

18_85 11_84 FC2 Female Condom: Demand Should Continue to Grow Globally Continued Global Focus on HIV AIDS – leading cause of death women age 15-44 35 million persons living with AIDS, 2.3 million newly infected in 2012 Increasing incidence of STIs around the world 20 million new cases every year in the US alone, half occurring in young people aged 15-24 Zika virus – global health emergency for pregnant and non-pregnant women Associated with severe birth defects like microcephaly & neurologic disease like Guillain–Barré syndrome CDC website 2016

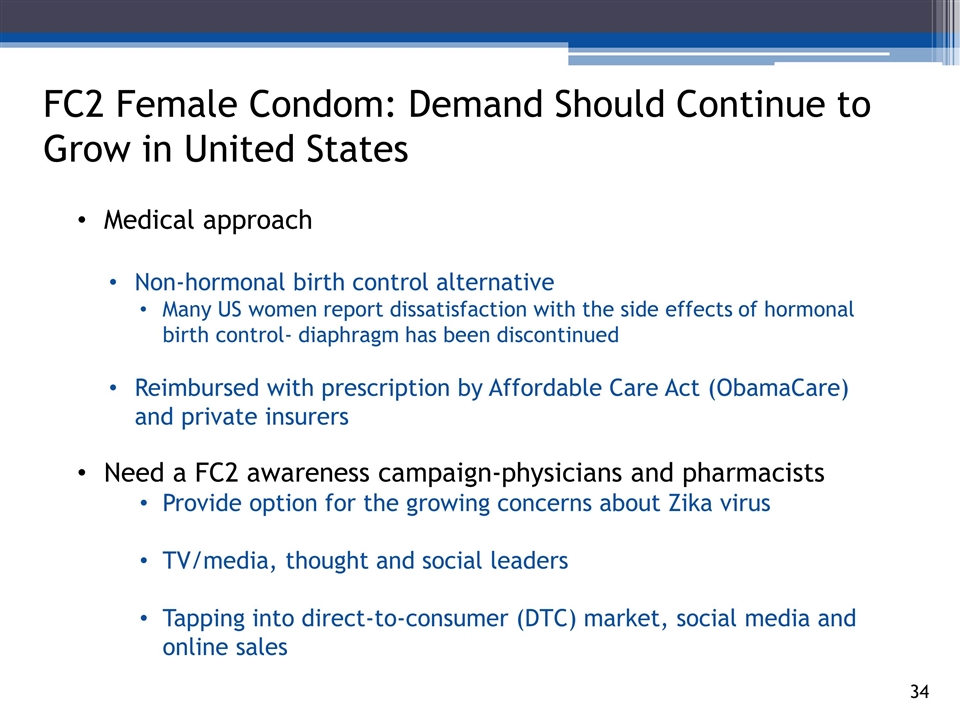

18_85 11_84 FC2 Female Condom: Demand Should Continue to Grow in United States Medical approach Non-hormonal birth control alternative Many US women report dissatisfaction with the side effects of hormonal birth control- diaphragm has been discontinued Reimbursed with prescription by Affordable Care Act (ObamaCare) and private insurers Need a FC2 awareness campaign-physicians and pharmacists Provide option for the growing concerns about Zika virus TV/media, thought and social leaders Tapping into direct-to-consumer (DTC) market, social media and online sales

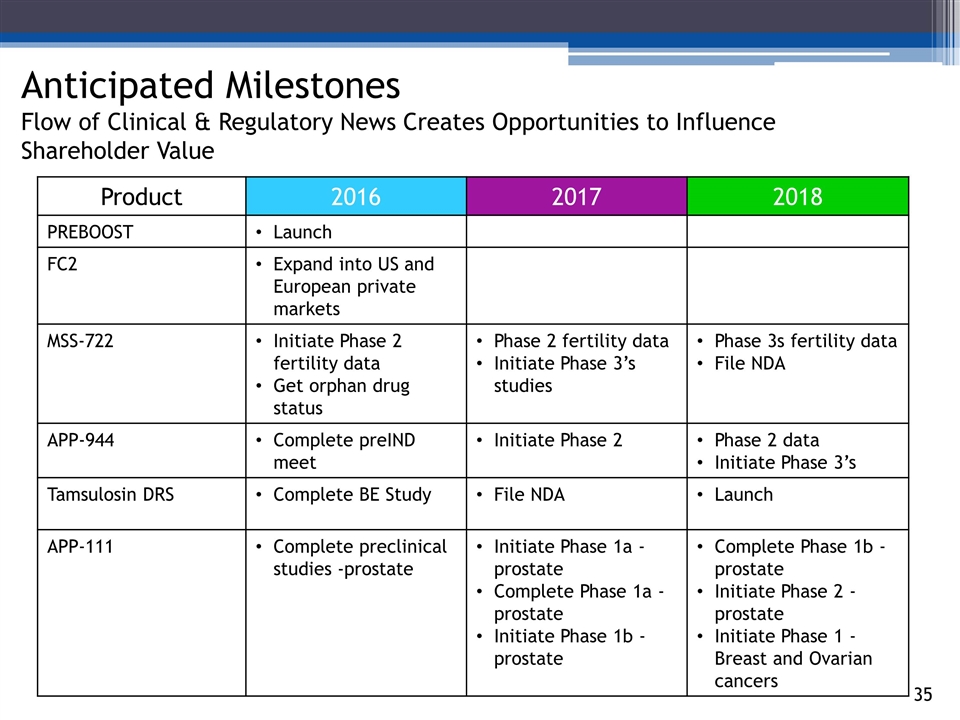

Anticipated Milestones Flow of Clinical & Regulatory News Creates Opportunities to Influence Shareholder Value 1471515_85 1471517_85 1471518_85 21_85 Product 2016 2017 2018 PREBOOST Launch FC2 Expand into US and European private markets MSS-722 Initiate Phase 2 fertility data Get orphan drug status Phase 2 fertility data Initiate Phase 3’s studies Phase 3s fertility data File NDA APP-944 Complete preIND meet Initiate Phase 2 Phase 2 data Initiate Phase 3’s Tamsulosin DRS Complete BE Study File NDA Launch APP-111 Complete preclinical studies -prostate Initiate Phase 1a - prostate Complete Phase 1a - prostate Initiate Phase 1b - prostate Complete Phase 1b - prostate Initiate Phase 2 - prostate Initiate Phase 1 - Breast and Ovarian cancers

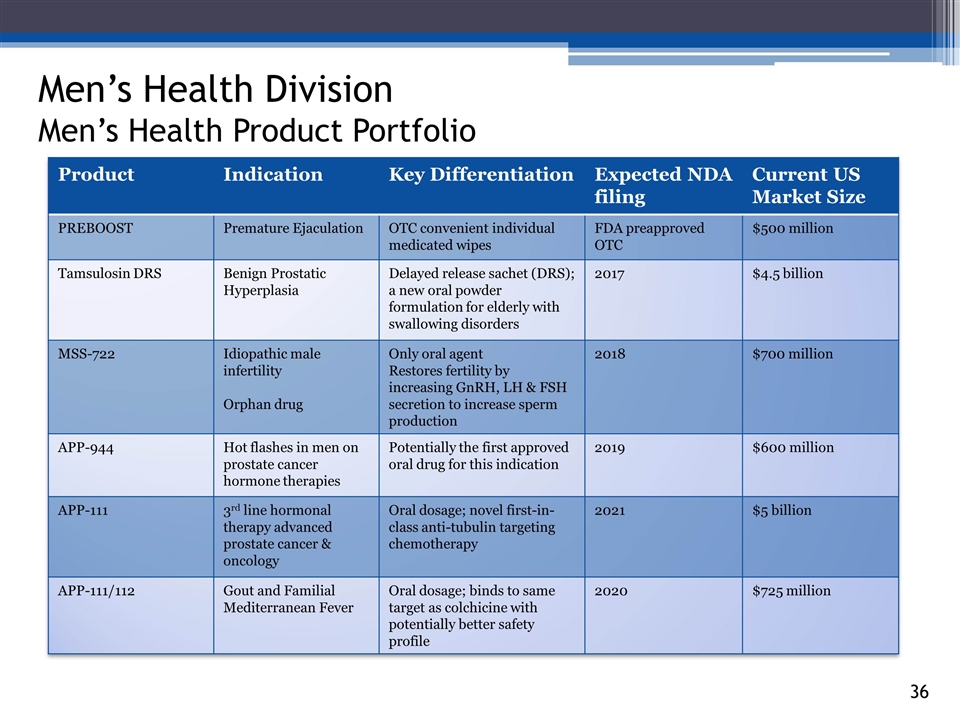

3_85 Men’s Health Division Men’s Health Product Portfolio Product Indication Key Differentiation Expected NDA filing Current US Market Size PREBOOST Premature Ejaculation OTC convenient individual medicated wipes FDA preapproved OTC $500 million Tamsulosin DRS Benign Prostatic Hyperplasia Delayed release sachet (DRS); a new oral powder formulation for elderly with swallowing disorders 2017 $4.5 billion MSS-722 Idiopathic male infertility Orphan drug Only oral agent Restores fertility by increasing GnRH, LH & FSH secretion to increase sperm production 2018 $700 million APP-944 Hot flashes in men on prostate cancer hormone therapies Potentially the first approved oral drug for this indication 2019 $600 million APP-111 3rd line hormonal therapy advanced prostate cancer & oncology Oral dosage; novel first-in-class anti-tubulin targeting chemotherapy 2021 $5 billion APP-111/112 Gout and Familial Mediterranean Fever Oral dosage; binds to same target as colchicine with potentially better safety profile 2020 $725 million

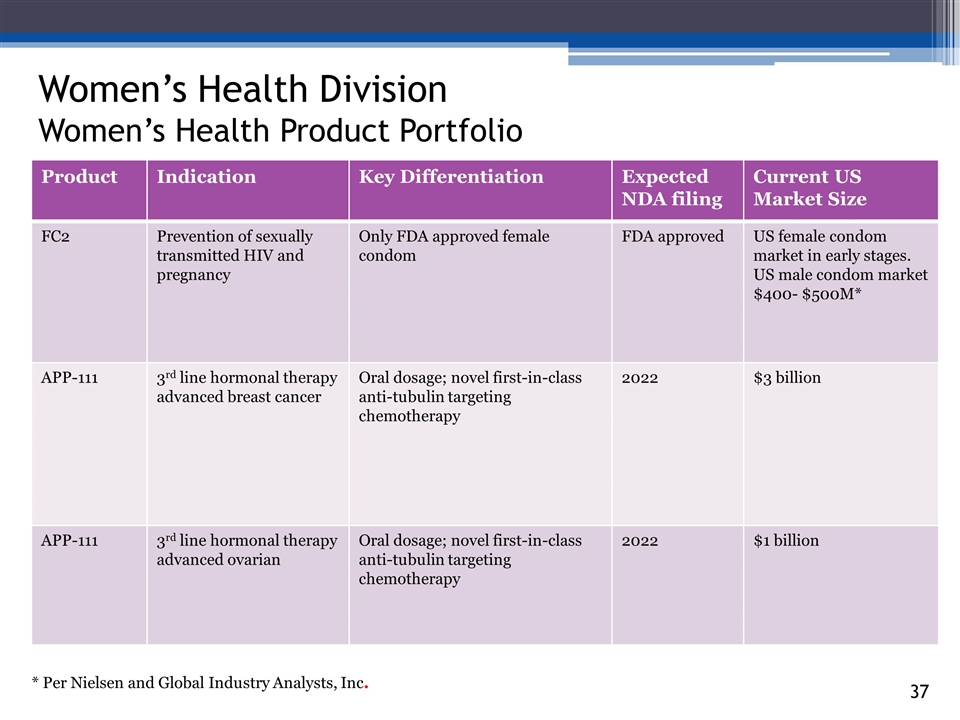

3_85 Women’s Health Division Women’s Health Product Portfolio Product Indication Key Differentiation Expected NDA filing Current US Market Size FC2 Prevention of sexually transmitted HIV and pregnancy Only FDA approved female condom FDA approved US female condom market in early stages. US male condom market $400- $500M* APP-111 3rd line hormonal therapy advanced breast cancer Oral dosage; novel first-in-class anti-tubulin targeting chemotherapy 2022 $3 billion APP-111 3rd line hormonal therapy advanced ovarian Oral dosage; novel first-in-class anti-tubulin targeting chemotherapy 2022 $1 billion * Per Nielsen and Global Industry Analysts, Inc.

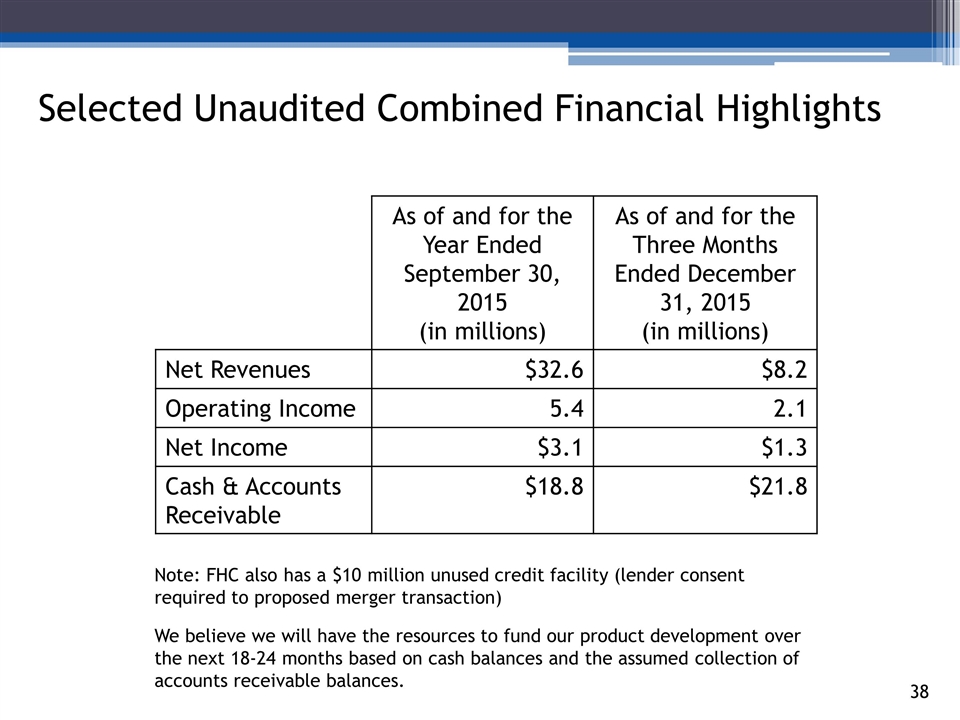

As of and for the Year Ended September 30, 2015 (in millions) As of and for the Three Months Ended December 31, 2015 (in millions) Net Revenues $32.6 $8.2 Operating Income 5.4 2.1 Net Income $3.1 $1.3 Cash & Accounts Receivable $18.8 $21.8 Selected Unaudited Combined Financial Highlights Note: FHC also has a $10 million unused credit facility (lender consent required to proposed merger transaction) We believe we will have the resources to fund our product development over the next 18-24 months based on cash balances and the assumed collection of accounts receivable balances.

Seasoned management team with over 30 years average experience in the medical industry FHC brings a financially strong company with a successful track record, while APP brings a multi-product portfolio with significant upside potential Combined company will have successful existing products, together with an additional new product portfolio that offers investors upside potential for the near and long-terms A financially strong company that is unique for this stage of development in that it has revenue and earnings, no debt, and is cash flow positive 3_85 Why Vote For the Merger ?

THANK YOU

APPENDIX

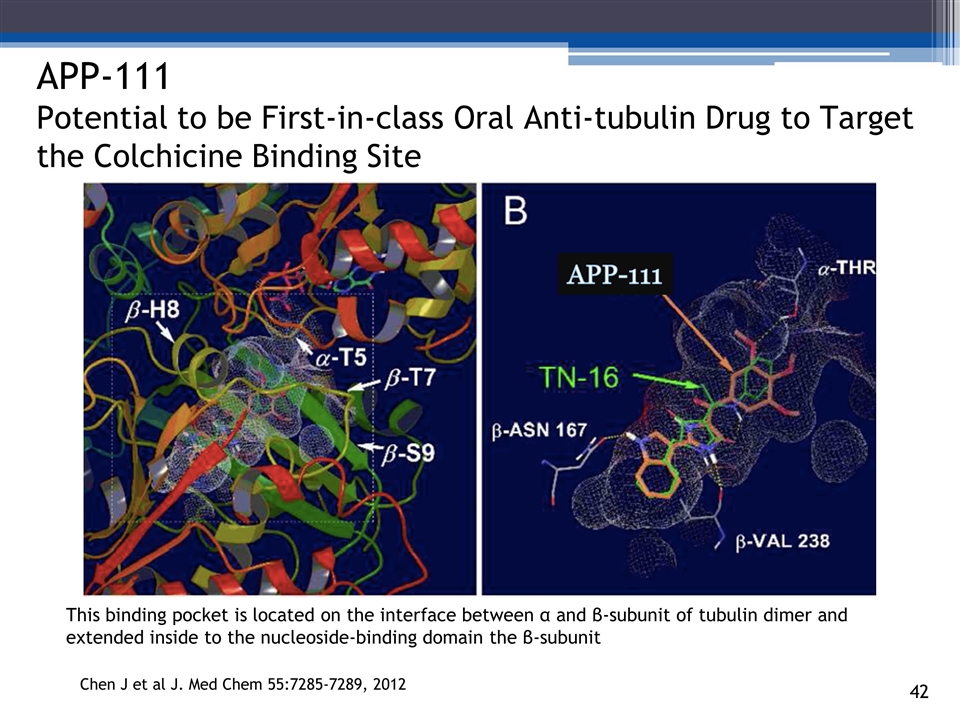

3_85 APP-111 Potential to be First-in-class Oral Anti-tubulin Drug to Target the Colchicine Binding Site Chen J et al J. Med Chem 55:7285-7289, 2012 APP-111 This binding pocket is located on the interface between α and β-subunit of tubulin dimer and extended inside to the nucleoside-binding domain the β-subunit