PROPOSAL 2: RATIFICATION OF APPOINTMENT OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Engagement of Independent Registered Public Accounting Firm

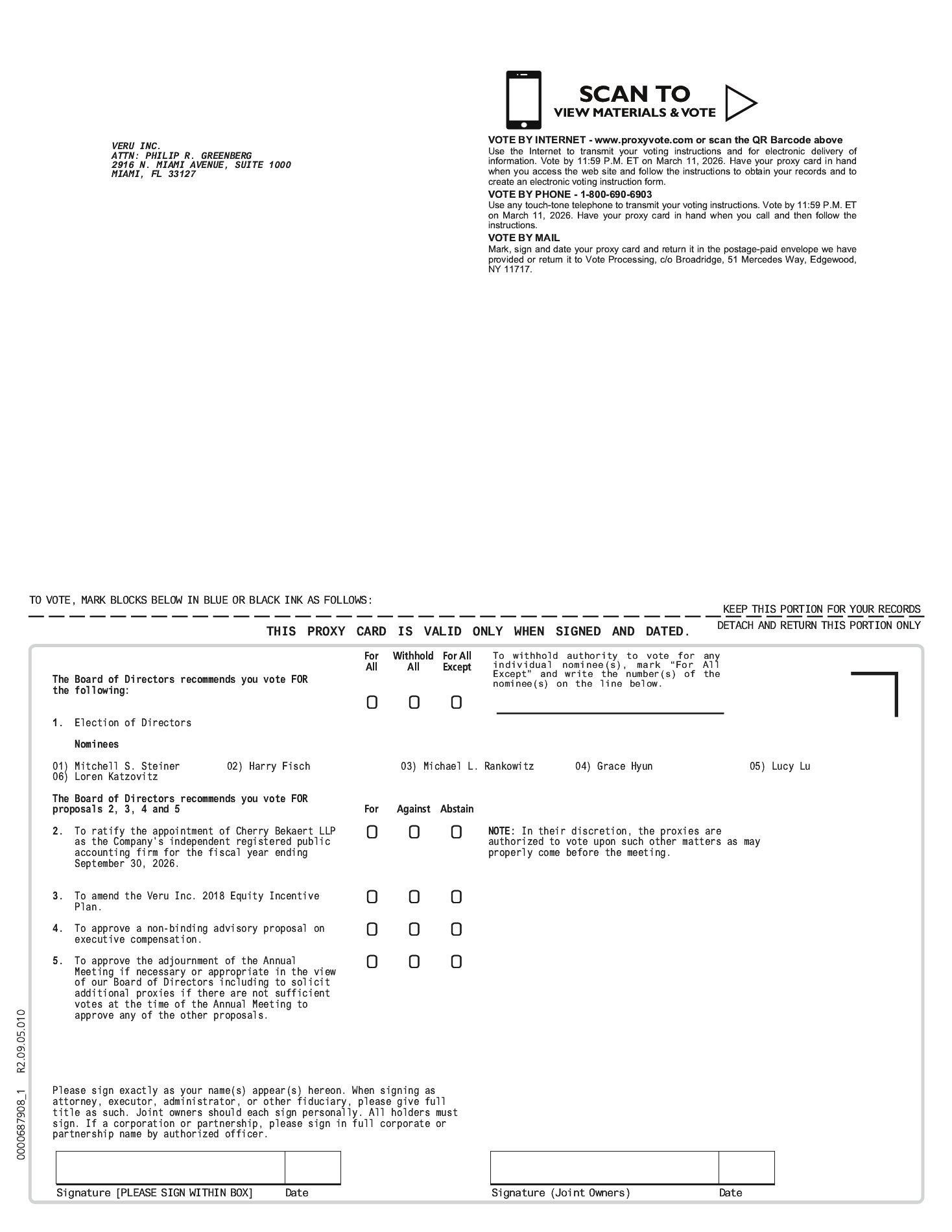

The Audit Committee of our Board of Directors has appointed Cherry Bekaert LLP as our independent registered public accounting firm, to audit our financial statements for the fiscal year ending September 30, 2026. The board of directors proposes that the shareholders ratify this appointment. We expect that representatives of Cherry Bekaert LLP will be present at the annual meeting, will be able to make a statement if they so desire, and will be available to respond to appropriate questions.

Prior Change of Independent Registered Public Accounting Firm

On May 22, 2024, we filed a Current Report on Form 8-K (the “Form 8-K”) with the SEC reporting that, on May 16, 2024, we dismissed RSM US LLP as our independent registered public accounting firm, and Cherry Bekaert LLP was engaged as our new independent registered public accounting firm on May 21, 2024. The decision to dismiss RSM US LLP and to retain Cherry Bekaert LLP was approved by our Audit Committee.

RMS US LLP’s reports on the Company’s consolidated financial statements for each of the fiscal years ended September 30, 2023 and September 30, 2022 did not contain an adverse opinion or disclaimer of opinion, nor were they qualified or modified as to uncertainty, audit scope or accounting principles, except that the report for the fiscal year ended September 30, 2023 included an explanatory paragraph indicating that there was substantial doubt about the Company’s ability to continue as a going concern. During the fiscal years ended September 30, 2023 and September 30, 2024 and through May 16, 2024, there were no disagreements with RSM US LLP on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure which, if not resolved to RSM US LLP’s satisfaction, would have caused them to make reference to the subject matter in connection with their report on the Company’s consolidated financial statements for such years; and there were no reportable events, as listed in Item 304(a)(1)(v) of SEC Regulation S-K, except for (A) the material weakness in the Company’s internal control over financial reporting disclosed in Part I, Item 4 of the Company’s Form 10-Q/A for the quarter ended June 30, 2023 filed with the SEC on November 15, 2023, which resulted in a restatement of the Company’s previously issued unaudited condensed consolidated financial statements as of and for the three and nine months ended June 30, 2023, as a material weakness in the Company’s internal control over financial reporting was identified related to its controls over applying technical accounting guidance to nonrecurring events and transactions, specific to the evaluation of information that was known or knowable at the time of the transaction or event, and (B) the material weakness in the Company’s internal control over financial reporting disclosed in Part II, Item 9A of the Company’s Form 10-K/A for the year ended September 30, 2023 filed with the SEC on April 1, 2024, which resulted in a restatement of the Company’s previously issued consolidated financial statements as of and for the years ended September 30, 2023 and 2022, as a material weakness in the Company’s internal control over financial reporting was identified related to its management review control over its estimate of research and development expenses associated with activities conducted by third-party service providers.

On May 21, 2024, following approval by the Audit Committee, we engaged Cherry Bekaert LLP as our new independent registered public accounting firm to succeed RSM US LLP. In deciding to appoint Cherry Bekaert LLP, the Audit Committee reviewed auditor independence and existing commercial relationships with Cherry Bekaert LLP and concluded that Cherry Bekaert LLP had no commercial relationship with the Company that would impair its independence for the fiscal year ending September 30, 2024.

We provided RSM US LLP with a copy of the disclosures in the Form 8-K prior to filing the Form 8-K. We requested that RSM US LLP furnish us with a letter addressed to the SEC stating whether RSM US LLP agrees with the statements made by us regarding RSM US LLP in the Form 8-K and, if not, stating the respects in which it does not agree. A copy of RSM US LLP’s letter dated May 22, 2024 to the SEC, stating that it agrees with the statements made in the Form 8-K, was filed as Exhibit 16.1 to the Form 8-K filed on May 22, 2024.

During the fiscal years ended September 30, 2023 and September 30, 2022, and the subsequent interim period through May 21, 2024, the Company did not consult with Cherry Bekaert LLP regarding any of the matters or events set forth in Item 304(a)(2)(i) and (ii) of SEC Regulation S-K.

Vote Required for Approval and Board Recommendation

In the event that ratification of the appointment of Cherry Bekaert LLP as the independent registered public accounting firm for the Company is not obtained at the Annual Meeting, the Audit Committee of our Board of